Recent Trading Activity

Market Conditions

(Click on image to enlarge)

Stochastics: 74 (Neutral. Down from 96 last week)

McClellan: -12 (Neutral. Down from +102 last week)

Stocks above their 20 DMA: 59% (Neutral. Down from 68% last week)

No man's land

The 2800 level proved to be strong resistance again. I'm keeping the idea that the playing range is 2,660 to 2,800 for now (I removed the potential support down at 2,540 for now).

The SPX index closed last Friday at 2779.03 and this Friday it closed at an almost identical 2779.66. Yet, all three oscillators went down clearly. I usually see this bearish divergence as a predecessor of price declines. Obviously, nothing is 100% certain in the markets, but I have a small bearish bias for the upcoming week.

The Russell Index:

(Click on image to enlarge)

Still firmly in all-time high territory but struggling a bit to keep going. My position there (yellow lines), probably a little too close on the Put side. Byproduct of entering the position so late at 38 days to expiration instead of the usual 42.

Action Plan for the Week

- No plan other than to baby-sit the two July Elephants. If we were to reach an oversold market, then I'd play a small SPX Credit Put spread using July options, but that market condition may not be reached this week.

Economic Calendar

Monday: A few FOMC members speak. Also, the president of the European Central Bank will speak.

Tuesday: US Building Permits, Housing Starts. ECB President Draghi speaks again.

Wednesday: Fed Chairman Powel speaks. ECB President Draghi speaks (again!). Existing Home Sales.

Thursday: Philly Fed Manufacturing Index.

Friday: Europe Services and Manufacturing PMI. European Union Finance Ministries meeting.

Good luck this week folks,

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

- Took a $755 loss on Call side of the July SPX Elephant on Monday.

- Initiated a July RUT Elephant on Tuesday for a credit of $1,684.

- Put side of June Elephant expired on Friday. A $1,004 gain.

- Initiated a July RUT Elephant on Tuesday for a credit of $1,684.

- Put side of June Elephant expired on Friday. A $1,004 gain.

Market Conditions

(Click on image to enlarge)

Stochastics: 74 (Neutral. Down from 96 last week)

McClellan: -12 (Neutral. Down from +102 last week)

Stocks above their 20 DMA: 59% (Neutral. Down from 68% last week)

No man's land

The 2800 level proved to be strong resistance again. I'm keeping the idea that the playing range is 2,660 to 2,800 for now (I removed the potential support down at 2,540 for now).

The SPX index closed last Friday at 2779.03 and this Friday it closed at an almost identical 2779.66. Yet, all three oscillators went down clearly. I usually see this bearish divergence as a predecessor of price declines. Obviously, nothing is 100% certain in the markets, but I have a small bearish bias for the upcoming week.

The Russell Index:

(Click on image to enlarge)

Still firmly in all-time high territory but struggling a bit to keep going. My position there (yellow lines), probably a little too close on the Put side. Byproduct of entering the position so late at 38 days to expiration instead of the usual 42.

Current Portfolio:

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Jul. SPX/SPY 2490/2500 - 255 Put side of Elephant

Net Credit: $1,057. Five weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,565 to the downside (adjust Put side).

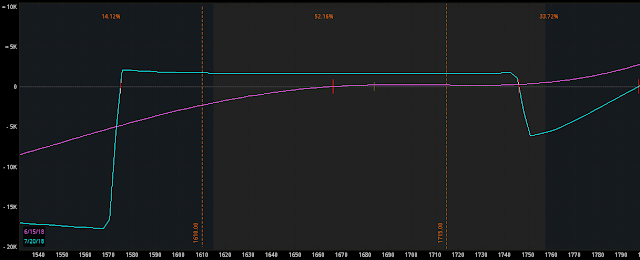

Jul. RUT/IWM 1570/1575/1745/1750 - 159/175 Elephant

Net Credit: $1,684. Five weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,610 to the downside (adjust Put side). 1,715 to the upside (close Calls at a loss, keep riding Put side, which has a credit that is greater than the Call side loss.

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Jul. SPX/SPY 2490/2500 - 255 Put side of Elephant

Net Credit: $1,057. Five weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,565 to the downside (adjust Put side).

Jul. RUT/IWM 1570/1575/1745/1750 - 159/175 Elephant

Net Credit: $1,684. Five weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,610 to the downside (adjust Put side). 1,715 to the upside (close Calls at a loss, keep riding Put side, which has a credit that is greater than the Call side loss.

Action Plan for the Week

- No plan other than to baby-sit the two July Elephants. If we were to reach an oversold market, then I'd play a small SPX Credit Put spread using July options, but that market condition may not be reached this week.

Economic Calendar

Monday: A few FOMC members speak. Also, the president of the European Central Bank will speak.

Tuesday: US Building Permits, Housing Starts. ECB President Draghi speaks again.

Wednesday: Fed Chairman Powel speaks. ECB President Draghi speaks (again!). Existing Home Sales.

Thursday: Philly Fed Manufacturing Index.

Friday: Europe Services and Manufacturing PMI. European Union Finance Ministries meeting.

Good luck this week folks,

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment