Recent Trading Activity

Market Conditions

(Click on image to enlarge)

Stochastics: 96 (Overbought. Up from 68 last week)

McClellan: +102 (Neutral. Up from +58 last week)

Stocks above their 20 DMA: 68% (Neutral. Up from 63% last week)

No man's land

The index is about 3% higher than its 50-Day average. This still leaves a little room to the upside but it starts to become limited. We are getting close to 2,800 which may be potential horizontal resistance. I still favor the upside, but something like a 2% move higher would favor downside action or at least some sideways consolidation.

The Russell Index:

(Click on image to enlarge)

RUT firmly in all-time high territory and about 5.5% higher than its 50-day average. This is starting to become a little stretched.

Action Plan for the Week

- I intend to enter a July RUT position on Monday (tomorrow)

- Due to capital limitations, I will have to close one of the June positions. They are both sure winners by now, and could be left to expire worthless, but they take up margin that would make the previous trade idea impossible. So, I'll close one of them.

Economic Calendar

Tuesday: US Core CPI. Federal Budget Balance.

Wednesday: US PPI. FOMC Statement. FOMC Economic Projections.

Thursday: US Retail Sales, European Central Bank Press Conference.

Friday: Europe CPI, US Michigan Consumer Sentiment.

Cheers,

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

- No activity. Tried a July RUT Elephant at the end of Friday session but didn't get the fills I tried.

Market Conditions

(Click on image to enlarge)

Stochastics: 96 (Overbought. Up from 68 last week)

McClellan: +102 (Neutral. Up from +58 last week)

Stocks above their 20 DMA: 68% (Neutral. Up from 63% last week)

No man's land

The index is about 3% higher than its 50-Day average. This still leaves a little room to the upside but it starts to become limited. We are getting close to 2,800 which may be potential horizontal resistance. I still favor the upside, but something like a 2% move higher would favor downside action or at least some sideways consolidation.

The Russell Index:

(Click on image to enlarge)

RUT firmly in all-time high territory and about 5.5% higher than its 50-day average. This is starting to become a little stretched.

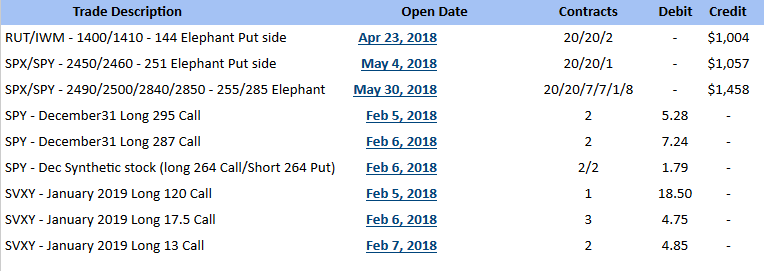

Current Portfolio:

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Jun. RUT/IWM 1400/1410 - 144 Elephant Put side

Net Credit: $1,004. One week to expiration.

(Click on image to enlarge)

Defense line: 1,445 to the downside. This position is at max profit and can be closed. Of course, for closing it, you need to give away a few cents as brokers won't give you a fill for 0.00 debit.

Jun. SPX/SPY 2450/2460 - 251 Elephant Put side

Net Credit: $1,057. One week to expiration.

(Click on image to enlarge)

Defense lines: 2,535 to the downside. Same as above. This is a full winner at expiration in a few days.

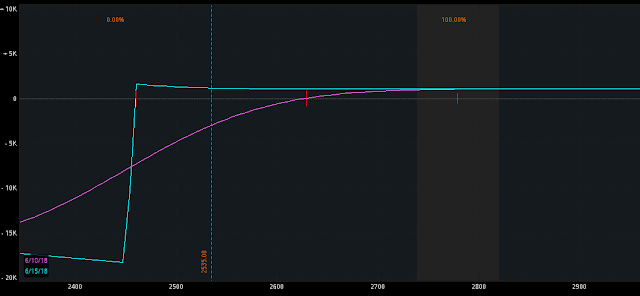

Jul. SPX/SPY 2490/2500/2840/2850 - 255/285 Elephant

Net Credit: $1,458. Six weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,575 to the downside (adjust Put side). 2,790-2,795 to the upside (close Calls at a loss, keep riding Put side, which has a credit that is greater than the Call side loss.

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Jun. RUT/IWM 1400/1410 - 144 Elephant Put side

Net Credit: $1,004. One week to expiration.

(Click on image to enlarge)

Defense line: 1,445 to the downside. This position is at max profit and can be closed. Of course, for closing it, you need to give away a few cents as brokers won't give you a fill for 0.00 debit.

Jun. SPX/SPY 2450/2460 - 251 Elephant Put side

Net Credit: $1,057. One week to expiration.

(Click on image to enlarge)

Defense lines: 2,535 to the downside. Same as above. This is a full winner at expiration in a few days.

Jul. SPX/SPY 2490/2500/2840/2850 - 255/285 Elephant

Net Credit: $1,458. Six weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,575 to the downside (adjust Put side). 2,790-2,795 to the upside (close Calls at a loss, keep riding Put side, which has a credit that is greater than the Call side loss.

Action Plan for the Week

- I intend to enter a July RUT position on Monday (tomorrow)

- Due to capital limitations, I will have to close one of the June positions. They are both sure winners by now, and could be left to expire worthless, but they take up margin that would make the previous trade idea impossible. So, I'll close one of them.

Economic Calendar

Tuesday: US Core CPI. Federal Budget Balance.

Wednesday: US PPI. FOMC Statement. FOMC Economic Projections.

Thursday: US Retail Sales, European Central Bank Press Conference.

Friday: Europe CPI, US Michigan Consumer Sentiment.

Cheers,

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment