Well, the time has come once again to go over my Options Trading performance for the cycle that just concluded: the November 2015 monthly options expiration cycle.

The goal of these articles is to recap and determine what went wrong, what went well, mistakes that were made, things that could have been done better. These articles are intended to make us better traders with constant feedback from our own recent actions and the community of like-minded readers that contribute to this site.

Although the main focus is the long term viability of the strategy and not the month to month seesaws, hopefully these monthly updates will provide confidence and serve as an authentic guide of what can be achieved with a realistic and sustainable approach to the business of selling Credit Spreads and Iron Condors.

It's important to realize that we don't need to double our accounts every year, which entails unsustainable risks. With a simple 2% monthly return, money grows at a rate of +26.82% per year. Start trading with $10,000 and obtain that return annually while investing 5,000 additional dollars out of your own pocket every year and you get close to the 1 million dollar mark in 15 years. And you don't even need to get that far to make it worth it. Relatively small portfolios can consistently generate $400, $500, $600 a month, a meaningful help in the budget of the average family. Whether you want to trade for a living or only as a side activity for supplemental income, you are only truly limited by your own will. How much are you willing to dedicate to studying and training hard? That's all there is to it.

And while there is absolutely no guarantee that anyone will achieve any arbitrary numerical return in the future, the fact is: the power of compounding is truly remarkable and can do wonders even with small amounts of money.

The Trades

On September 18, I started to trade November options. The November Options cycle was especially difficult to trade this year because the market was in full rally mode during the entire month of October, achieving one of its best months in history. Not only the sizable unidirectional move was a challenge, but also the fact that it was to the upside which I have argued 24,124 times is much more dangerous for options sellers than downside moves. So, that was the cruel battle we had to face this time.

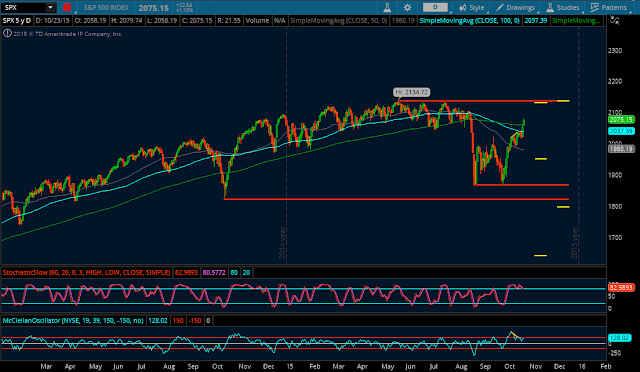

This is how the SPX index was looking on September 18

(Click on image to enlarge)

That day I entered an SPX November 1630/1640/2100/2110 Iron Condor.

Ten days later, on September 28, the SPX had fallen down to 1881. The Call side was showing a 2% probability of expiring in the money and I could have closed it for 0.20 - 0.25 debit. Like 80 - 85% of its max profit in only 10 days. It wasn't even October yet and this thing was expiring in November. That was my mistake right there and a big one unfortunately. Long time readers of this site know I tend to squeeze out the last penny of a position and take them to expiration as long as I don't feel threatened. However, from time to time I take a winner off early. Students of LTOptions have specific metrics to take winners off early on a quick move like this one where you make most of the gains in a few days. You just have to take that winner and give yourself a change to redeploy the capital on an eventual rebound as there is plenty of time left to expiration. In this particular case it was even more mandatory given that I was playing this position as a full, balanced Iron Condor. So upside risk was greater than usual.

It's so funny how you can spend the entire year playing unbalanced Iron Condors, making relatively easy money and lamenting not having collected more money from the Call sides throughout the year and then the one time you decide to go full on the Call side, that's when the market hits you. Ironies of life. Also funny how I'm disciplined enough to execute my trading plan 98% of the time, and that 2% I don't, the market ALWAYS punishes me. I should have taken this profit, as I explained in one of the Weekend Portfolio Analysis and miserably failed to execute. Most of my failures are due to greed not fear. I don't know, fear affects me much less in the markets. Perhaps as a byproduct of well thought-out plans in advance for every market move, or perhaps my "third world - poor little country boy who never had a penny anyways" background. I'm not afraid of taking a loss and digest it. Greed kills me way more frequently. Entering a position too early, or staying on it longer trying to make more money. I suggest you take a time and analyze yourself. Determine which of the two emotions in trading tends to betray you the most. Being totally conscious and aware of which one, will help you become a better speculator in the markets.

October 23 eventually came:

(Click on image to enlarge)

I had to swallow that loss on the Call side of the fully balanced Iron Condor. Still can't believe it. Had it been the typical unbalanced Iron Condor, I would now be kicking ass and not threatened to buy dinner for all my trading colleagues in our friendly competition. I took the loss on the 2100/2110 Call spread. I deployed a new one higher at 2130/2140, this time unbalanced. Fewer contracts. I also collected additional credit by Selling the 1945/1950 Put spread.

Of course the market had to keep moving up, after all it was resolute to making history. On November 3 I had to take a small loss on the 2130/2140 spread and then I deployed 2160/2165, full size this time with total confidence. Students of LTOptions know the worst historical market rallies for the strategy going back more than 6 decades and the maximum number of adjustments to make. I was gaining more and more confidence as the market kept relentlessly moving up. I didn't sell Puts this time as I was seeing a clear extreme market up there. This was the final adjustment which went on to be a winner. So, the whole progression was

1630/1640/2100/2110 full

to

1630/1640/2130/2140 unbalanced (taking loss on 2100/2110), also deployed new 1945/1950 Credit Put spread)

to

1630/1640/2160/2165 full (taking loss on 2130/2140)

Winners at expiration: 1630/1640 CPS, 1945/1950 CPS, 2160/2165 CCS.

The result of this whole non-sense was a -$245 loss. Or barely more than 2% of the portfolio in almost two months. If I had taken the call side winner off early, yes eventually I would have redeployed it again and I would have lost but I would have had a winner already in my pocket to balance that out. In the other case, assuming no way in heaven would I have taken that Call side winner off early, but if at least I had played this as an unbalanced Iron Condor, this -$245 loss would have only been a minuscule -$25 to -$50 loss overall in the end. Which to me is remarkable in such a strong market rally in a period where many options trading newsletters lost their respective arrières.

The other complementary trade of the cycle was a RUT 1235/1240 Credit Call spread where I took a winner off early on a little retracement during the monstrous rally, totally following my laid out action plan from that weekend.

Summing up, two mistakes: Not having played the unbalanced Iron Condor variation. That was the first one. I suggest to go fully balanced only when the market is close to overbought. Second: With excessive upside risk, not having taken a huge winner early on. I'm not pointing out mistakes just because I lost money. Had I played it perfectly this cycle I would have probably had a negative month anyways without making mistakes in my book. You just cannot win them all. It's just that in this case I did make clear mistakes which I mitigated with discipline and a strict risk management approach later, but mistakes nonetheless.

Final balance for the month -1.50%. Including commissions -1.82%

So, That was my number. What was yours?

If you are interested in a responsible and sustainable way of trading options for consistent income and a smooth equity curve, consider acquiring LTOptions, my options trading system revealed to the last detail.

The goal of these articles is to recap and determine what went wrong, what went well, mistakes that were made, things that could have been done better. These articles are intended to make us better traders with constant feedback from our own recent actions and the community of like-minded readers that contribute to this site.

Although the main focus is the long term viability of the strategy and not the month to month seesaws, hopefully these monthly updates will provide confidence and serve as an authentic guide of what can be achieved with a realistic and sustainable approach to the business of selling Credit Spreads and Iron Condors.

It's important to realize that we don't need to double our accounts every year, which entails unsustainable risks. With a simple 2% monthly return, money grows at a rate of +26.82% per year. Start trading with $10,000 and obtain that return annually while investing 5,000 additional dollars out of your own pocket every year and you get close to the 1 million dollar mark in 15 years. And you don't even need to get that far to make it worth it. Relatively small portfolios can consistently generate $400, $500, $600 a month, a meaningful help in the budget of the average family. Whether you want to trade for a living or only as a side activity for supplemental income, you are only truly limited by your own will. How much are you willing to dedicate to studying and training hard? That's all there is to it.

And while there is absolutely no guarantee that anyone will achieve any arbitrary numerical return in the future, the fact is: the power of compounding is truly remarkable and can do wonders even with small amounts of money.

The Trades

On September 18, I started to trade November options. The November Options cycle was especially difficult to trade this year because the market was in full rally mode during the entire month of October, achieving one of its best months in history. Not only the sizable unidirectional move was a challenge, but also the fact that it was to the upside which I have argued 24,124 times is much more dangerous for options sellers than downside moves. So, that was the cruel battle we had to face this time.

This is how the SPX index was looking on September 18

(Click on image to enlarge)

That day I entered an SPX November 1630/1640/2100/2110 Iron Condor.

Ten days later, on September 28, the SPX had fallen down to 1881. The Call side was showing a 2% probability of expiring in the money and I could have closed it for 0.20 - 0.25 debit. Like 80 - 85% of its max profit in only 10 days. It wasn't even October yet and this thing was expiring in November. That was my mistake right there and a big one unfortunately. Long time readers of this site know I tend to squeeze out the last penny of a position and take them to expiration as long as I don't feel threatened. However, from time to time I take a winner off early. Students of LTOptions have specific metrics to take winners off early on a quick move like this one where you make most of the gains in a few days. You just have to take that winner and give yourself a change to redeploy the capital on an eventual rebound as there is plenty of time left to expiration. In this particular case it was even more mandatory given that I was playing this position as a full, balanced Iron Condor. So upside risk was greater than usual.

It's so funny how you can spend the entire year playing unbalanced Iron Condors, making relatively easy money and lamenting not having collected more money from the Call sides throughout the year and then the one time you decide to go full on the Call side, that's when the market hits you. Ironies of life. Also funny how I'm disciplined enough to execute my trading plan 98% of the time, and that 2% I don't, the market ALWAYS punishes me. I should have taken this profit, as I explained in one of the Weekend Portfolio Analysis and miserably failed to execute. Most of my failures are due to greed not fear. I don't know, fear affects me much less in the markets. Perhaps as a byproduct of well thought-out plans in advance for every market move, or perhaps my "third world - poor little country boy who never had a penny anyways" background. I'm not afraid of taking a loss and digest it. Greed kills me way more frequently. Entering a position too early, or staying on it longer trying to make more money. I suggest you take a time and analyze yourself. Determine which of the two emotions in trading tends to betray you the most. Being totally conscious and aware of which one, will help you become a better speculator in the markets.

October 23 eventually came:

(Click on image to enlarge)

I had to swallow that loss on the Call side of the fully balanced Iron Condor. Still can't believe it. Had it been the typical unbalanced Iron Condor, I would now be kicking ass and not threatened to buy dinner for all my trading colleagues in our friendly competition. I took the loss on the 2100/2110 Call spread. I deployed a new one higher at 2130/2140, this time unbalanced. Fewer contracts. I also collected additional credit by Selling the 1945/1950 Put spread.

Of course the market had to keep moving up, after all it was resolute to making history. On November 3 I had to take a small loss on the 2130/2140 spread and then I deployed 2160/2165, full size this time with total confidence. Students of LTOptions know the worst historical market rallies for the strategy going back more than 6 decades and the maximum number of adjustments to make. I was gaining more and more confidence as the market kept relentlessly moving up. I didn't sell Puts this time as I was seeing a clear extreme market up there. This was the final adjustment which went on to be a winner. So, the whole progression was

1630/1640/2100/2110 full

to

1630/1640/2130/2140 unbalanced (taking loss on 2100/2110), also deployed new 1945/1950 Credit Put spread)

to

1630/1640/2160/2165 full (taking loss on 2130/2140)

Winners at expiration: 1630/1640 CPS, 1945/1950 CPS, 2160/2165 CCS.

The result of this whole non-sense was a -$245 loss. Or barely more than 2% of the portfolio in almost two months. If I had taken the call side winner off early, yes eventually I would have redeployed it again and I would have lost but I would have had a winner already in my pocket to balance that out. In the other case, assuming no way in heaven would I have taken that Call side winner off early, but if at least I had played this as an unbalanced Iron Condor, this -$245 loss would have only been a minuscule -$25 to -$50 loss overall in the end. Which to me is remarkable in such a strong market rally in a period where many options trading newsletters lost their respective arrières.

The other complementary trade of the cycle was a RUT 1235/1240 Credit Call spread where I took a winner off early on a little retracement during the monstrous rally, totally following my laid out action plan from that weekend.

Summing up, two mistakes: Not having played the unbalanced Iron Condor variation. That was the first one. I suggest to go fully balanced only when the market is close to overbought. Second: With excessive upside risk, not having taken a huge winner early on. I'm not pointing out mistakes just because I lost money. Had I played it perfectly this cycle I would have probably had a negative month anyways without making mistakes in my book. You just cannot win them all. It's just that in this case I did make clear mistakes which I mitigated with discipline and a strict risk management approach later, but mistakes nonetheless.

Year to Date, using expiration dates as check-points:

Final balance for the month -1.50%. Including commissions -1.82%

So, That was my number. What was yours?

If you are interested in a responsible and sustainable way of trading options for consistent income and a smooth equity curve, consider acquiring LTOptions, my options trading system revealed to the last detail.

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment