Yesterday I entered a RUT credit put spread using strikes 905/910

BUY 4 June 905 PUT

SELL 4 June 910 PUT

Credit: 0.50 ($200)

Max Risk: 4.50 ($1800)

Max return on risk: 11.11%

Days to expiration: 28

This spread now completes an Iron Condor when combined with the 1025/1030 Bear Call spread

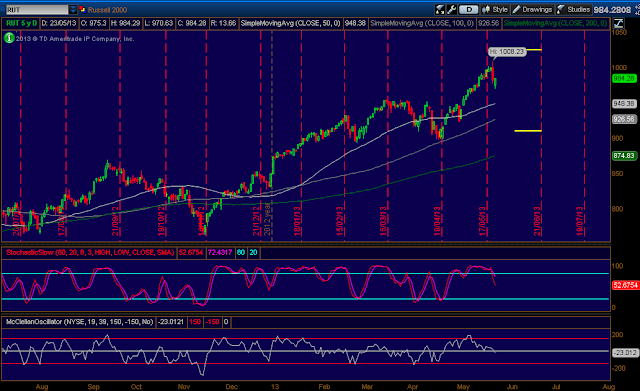

Finally a chart of RUT at market close for future reference:

(Click on image to enlarge)

Check out track record for 2013

Relater Articles:

Weekend Portfolio Analysis (05-26-2013)

Weekend Portfolio Analysis (2013-06-02)

Weekend Portfolio Analysis (June 8, 2013)

Weekend Portfolio Analysis (June 14, 2013)

Rut 910/905 bull put spread in June for .50 credit. Now an Ic 905/910/1025/1030

— The Lazy Trader (@lazytrading) May 23, 2013

BUY 4 June 905 PUT

SELL 4 June 910 PUT

Credit: 0.50 ($200)

Max Risk: 4.50 ($1800)

Max return on risk: 11.11%

Days to expiration: 28

This spread now completes an Iron Condor when combined with the 1025/1030 Bear Call spread

Finally a chart of RUT at market close for future reference:

(Click on image to enlarge)

Check out track record for 2013

Relater Articles:

Weekend Portfolio Analysis (05-26-2013)

Weekend Portfolio Analysis (2013-06-02)

Weekend Portfolio Analysis (June 8, 2013)

Weekend Portfolio Analysis (June 14, 2013)

Go to the bottom of this page in order to see the Legal Stuff

This looks like a good trade so far. Markets are down today again. I like to sell bull put spreads on big down days since premiums are a bit more. Have you had any problems with getting fills on 5-wide spreads? I heard 10-wide spreads are easier to get filled.

ReplyDeleteThanks.

Hey Jonathan,

ReplyDeleteYes I like to sell Puts when markets are a little bit more oversold (which they are not at all) the reason for this trade was in order to balance the risk on the overall portfolio. Before this, there wear two Bear Call Spreads and only one Bull Put spread.

As for problems getting filled on 5 point wide. Nop. Fills are pretty good with RUT. SP is a whole different story.

Regards,

LT