I opened a RUT 860/865 Credit Call Spread on Tuesday. All the ingredients signaling and imminent pull back were present. Stochastics were over 80, RSI over 70, McClellan Oscillator around +175, 78% of stocks above their 20 SMA and 73% above their 50 SMA and the pull back began a few minutes after opening the position. Sweet.

As a result, this trade is showing an unrealized profit of +$255 out of its maximum potential of $390. The position is comfortable and showing an 86.57% probability of successful expiration by September 21.

(Click on image to enlarge)

With the RUT 860/865 Bear Call spread open and the SPY 145/147 Bear Call spread still present in the portfolio, suddenly I found myself with double upside exposure in the portfolio. Even with an overbought market, it could still go up and up stubbornly and really cause some damage. So, right after the trade I decided to sell some puts via a RUT 780/775 Put Credit spread. Everyone knows that I only sell Puts when the markets are oversold (less than 30% of stocks above their 20 SMA, Stochastics below 20, McClellan oscillator below -150). Some readers have asked me via email why I did this. I would appreciate those questions to be posted right on the articles in the comments section next time. That way the questions remain visible to everyone, and it also saves me time when I have to post an answer just once rather than replying to multiple emails individually.

So, here's the logic. The markets had been going up non-stop regardless of news of any sort. The Bears have their wounds still open and too recent. Let's face it, everybody on planet earth was Bearish when August started, that is too many traders burned in recent days trying to short the market. Their pain is still too recent and the shorting wave lacks strengths. That's how we get these stubborn overextended upside markets. And also with light volumes not seen since 2007, and a relative absence of high impact news until the first week of September, I thought we wouldn't experience a huge panic sell off in two weeks. That would give me the opportunity to sell some Puts and some how mitigate the double upside exposure on the portfolio. If the markets kept going up, at least my Bull Put Spreads would make me some money, and if the markets went down, better then because although I would be losing money on this trade, I would more than be making up for it with profit coming out of my two Bear Call positions. This strategy is not new and in fact, if you have been a reader for sometime you know that I have already used it in the past, for example back in June with this trade.

The RUT 780/775 Put credit spread was open when RUT was trading at 825.98. Right now RUT is priced at 809.19 and consequently this position has a temporary loss of -$240. But nothing out of control and still a useful hedge for the portfolio. 73.26% chance of successful expiration in 27 days.

(Click on image to enlarge)

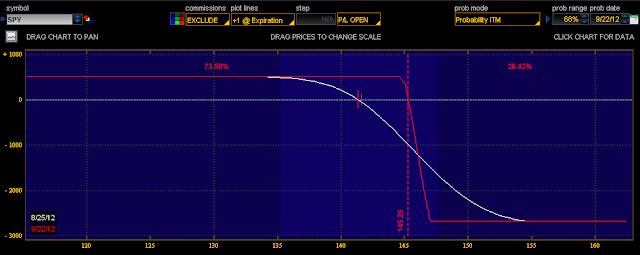

Finally my veteran of this cycle. The SPY 145/147 Bear Call spread, finally got some relief this week. With a 73.58% probability of successful expiration and a -$56 temporary loss, it is well under control.

(Click on image to enlarge)

So, what is the plan going forward?

Well, obviously out of the 3 positions, the RUT 860/865 Call Credit spread is the most comfortable one. The one that lets me sleep well at night. So, that's the one I want to keep and take all the way to expiration for a full $390 profit. I think chances are good for that to happen.

The other two positions are my shenanigans. I don't feel comfortable holding those, so I would like to get rid of them. If I can close both the SPY 145/147 and the RUT 780/775 for a breakeven result, I will do it. SPY 145/147 was sold for a 0.32 credit. If I can close it for 0.26 debit, that will cover my commission in/out. As for RUT 780/775 initial credit 0.60 if I can close it for 0.54 that will cover my commission costs as well. But here's the thing, I would like to close them both the same day, ideally. And in order for that to happen I have theta in my favor at least one more week. I really want to close the RUT 780/775 this upcoming week, or early next one. The 780 level is close, and September is the most bearish month for the markets statistically speaking. Plus there are too many dark clouds on the horizon for the world's economy. But for now like I said, I will keep them both and take advantage of time decay for one more week to get a better exit. Once the first week of September starts, with the high impact news, GDP, Unemployment etc, I would just be under too much stress with all three positions open. But until then, I will take advantage of theta before closing my two demons at better prices. I will not sell any Puts under these conditions, in any case I will adjust the RUT 780/775 if RUT hits 782. I will not sell more Calls either this week. If SPY reaches 144.80 I will adjust further up to probably 147/149. So, definitely no new trades this week, except adjustments if the market threatens my existing ones. Other than that just give myself sometime and let the Theta come to me.

So where's the market headed?

This is my brief analysis, and you know I don't like to over complicate things. We are in the middle of an uptrend channel.

(Click on image to enlarge)

Stochastics are not oversold nor overbought. The McClellan Oscillator showing a neutral reading at -27. 60% of stocks above their 20 SMA and 62% above their 50 SMA, certainly not overbought and far from oversold. I believe we are in no man's land here. One more reason to not sell options this week unless we reach one of the extremes. So, I will just limit myself to managing the risk on my existing positions.

Possible high impact news this week:

Tuesday - Consumer confidence at 10:00am

Wednesday - GDP Annualised (Prelim) 8:30am

Thursday - Personal spending, Personal income, Initial claims 8:30am

Friday - Chicago PMI

Plus, obviously anything coming out of Europe and China.

Be patient, and be profitable my friends!

Check out Demo-Record

Go to the bottom of this page in order to see the Legal Stuff

Also the Fed meeting in Jackson Hole is coming up this weekend. Could make for a volatile market based on what they say about QE3.

ReplyDeleteYes, you're absolutely right. I usually watch the upcoming news here http://www.babypips.com/tools/forex-calendar/

ReplyDeleteDo you use any other site with an economic calendar that is up to date during the weekend?