Recent Trading Activity

- Initiated a RUT Dec29 1330/1320 Credit Put Spread position for $300 Credit on Wednesday. It was a very short lived oversold condition. I tweeted out the trade entry live as usual. You can follow me on Twitter through this link if you like.

- NOV SPX 2315/2325 Credit Put spread expired for max gains +$1,000.

- NOV SPX 2425/2420 Credit Put spread expired for max gains +$250.

- NOV RUT 1380/1390/1580/1590 Unbalanced Iron Condor expired for max gains +$1,555

- Initiated a RUT Dec29 1330/1320 Credit Put Spread position for $300 Credit on Wednesday. It was a very short lived oversold condition. I tweeted out the trade entry live as usual. You can follow me on Twitter through this link if you like.

- NOV SPX 2315/2325 Credit Put spread expired for max gains +$1,000.

- NOV SPX 2425/2420 Credit Put spread expired for max gains +$250.

- NOV RUT 1380/1390/1580/1590 Unbalanced Iron Condor expired for max gains +$1,555

Market Conditions

(Click on image to enlarge)

Stochastics: 48 (Neutral. Down from 68 last week)

McClellan: -22 (Neutral. Up from -112 last week)

Stocks above their 20 DMA: 49% (Neutral. Up from 42% last week)

No man's land.

An interesting back and forth in SPX last week, taking the VIX to 11.43. The market is still very close to all time highs and the oscillators are signaling plenty of upside room to take those highs. I'm still using the first red line as uptrend resistance, pointing to a maximum SPX value of 2,620 for this week. Anything can happen at any time in the markets, but I think SPX > 2,620 is a tall order, especially for a shortened trading week. To the downside, SPX 2,550 would most likely put us in oversold territory.

The Russell:

(Click on image to enlarge)

The RUT actually had a strong week after having been consistently weaker than the S&P for a few days. The upper red line has pretty much lost all relevance at this point. If nothing interesting happens around it this week, I'll remove it from the chart. Yellow lines depicting current positions as usual, both looking great.

Current Portfolio

DEC SPX 2390/2400/2635/2640 Unbalanced Iron Condor

Net credit: $1,555. Four weeks to expiration. Put side looking great at 6 deltas. Call side now comfortable at 11 deltas.

(Click on image to enlarge)

Defense lines: 2,460 to the downside (adjust Put side) and 2,630 to the upside (adjust Call side). We can delay the Call side adjustment given the conservative 4 to 1 ratio of Puts/Calls played in this position.

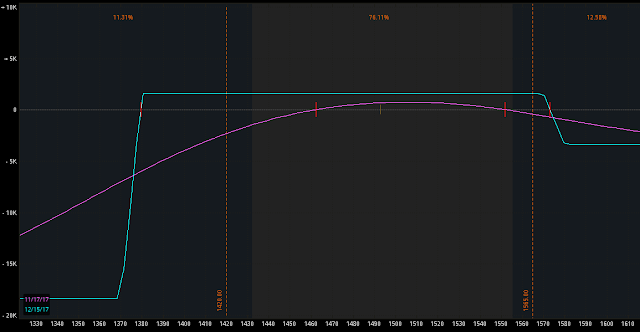

DEC RUT 1370/1380/1570/1580 Unbalanced Iron Condor

Net credit: $1,555. Four weeks to expiration. 6 deltas on the PUT side and 7 deltas on the Call side. This is the very definition of a healthy position.

(Click on image to enlarge)

Defense lines: 1,420 to the downside (adjust Put side) and 1,565 to the upside (adjust Call side).

DEC29 RUT 1330/1320 Credit Put spread

A small $300 credit position to start putting the finishing touches to the year. Six weeks to expiration. Very healthy already at just 5 deltas.

(Click on image to enlarge)

Defense line: 1,335 (adjust Put side)

Because of the small position size we can delay the adjustment here to that level of 45-48 deltas without facing a disaster.

DEC SPX 2390/2400/2635/2640 Unbalanced Iron Condor

Net credit: $1,555. Four weeks to expiration. Put side looking great at 6 deltas. Call side now comfortable at 11 deltas.

(Click on image to enlarge)

Defense lines: 2,460 to the downside (adjust Put side) and 2,630 to the upside (adjust Call side). We can delay the Call side adjustment given the conservative 4 to 1 ratio of Puts/Calls played in this position.

DEC RUT 1370/1380/1570/1580 Unbalanced Iron Condor

Net credit: $1,555. Four weeks to expiration. 6 deltas on the PUT side and 7 deltas on the Call side. This is the very definition of a healthy position.

(Click on image to enlarge)

Defense lines: 1,420 to the downside (adjust Put side) and 1,565 to the upside (adjust Call side).

DEC29 RUT 1330/1320 Credit Put spread

A small $300 credit position to start putting the finishing touches to the year. Six weeks to expiration. Very healthy already at just 5 deltas.

(Click on image to enlarge)

Defense line: 1,335 (adjust Put side)

Because of the small position size we can delay the adjustment here to that level of 45-48 deltas without facing a disaster.

Action Plan for the Week

- I'll take the DEC SPX 2635/2640 Credit Call spreads off the table if 0.30 debit becomes a real possibility. Original credit was 0.50 per. So, closing at 0.30 debit would be a net 0.20 gain, or $200 in 10 spreads in my case. At 11 deltas it is looking comfortable and the rule would be to just keep riding it. However, it has bothered me for so long, having never been below 10 deltas since it was entered. Anyways, the spread is showing a small gain at the moment. If you are sick of it, you can just go ahead and close it. If the market rallies and reaches 2,630 (which I consider to be unlikely), then I'll close it at a loss and deploy a new one in the 2,660 neighborhood. During that hypothetical rally I will first initiate a small Credit Put spread whenever the 2635 Call strikes reaches 30-32 deltas.

- If RUT rallies about 20 points and the DEC29 1590 Calls reach 10-11 deltas, I will sell a small position there (1590/1600). It will complete an Iron Condor with the 1330/1320 Put side entered this past week.

- Finally, the first position of the year 2018 will be initiated quite likely on Wednesday. This is because Thursday will be a Holiday and on Friday the markets will only open until 1pm. If I don't get the fill I want on Wednesday, then Friday will be the day. I'll go with the classic SPX Unbalanced Iron Condor. Current candidate: January 2365/2375/2675/2685, using a 4 to 1 ratio of Puts to Calls. These strike prices may change as the market moves. If the market rallies a bit and the 10-delta Calls happen to be at or above SPX 2,690 then I will feel more confident on the Call side and will use a 2 to 1 ratio of Puts to Calls instead (hence collecting more credit on the Call side). ). If, on the other hand, we get an oversold condition at any point in the week, I’ll simply go with a January Credit Put spread at 10-11 deltas.

Economic Calendar

As mentioned earlier, we have a shortened week of trading ahead of us due to Thanksgiving Day celebrations. In the last few years these weeks have been slow (activity wise) and typically characterized by lack of significant market moves and a small upside bias.

Monday: European Central Bank President Mario Draghi speaks.

Tuesday: US Existing Home Sales. Fed Chair Yellen speaks.

Wednesday: Core Durable Goods Orders. Michigan Consumer Sentiment and Expectations. FOMC Meeting Minutes.

Thursday: US Holiday (Thanksgiving Day)

Friday: US Holiday (The Day After Thanksgiving) - Early close at 1:00PM Eastern Time (New York)

Good luck this week and thanks for your support.

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2017 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment