Recent Trading Activity

- Closed the July SPX 2260/2250 Credit Put spread (remainder of an Unbalanced Iron Condor) on Monday for a $1,000 profit.

- Initiated an August RUT Unbalanced Lazy Elephant on Friday for a net credit of $1,418.

- Closed the July SPX 2260/2250 Credit Put spread (remainder of an Unbalanced Iron Condor) on Monday for a $1,000 profit.

- Initiated an August RUT Unbalanced Lazy Elephant on Friday for a net credit of $1,418.

Market Conditions

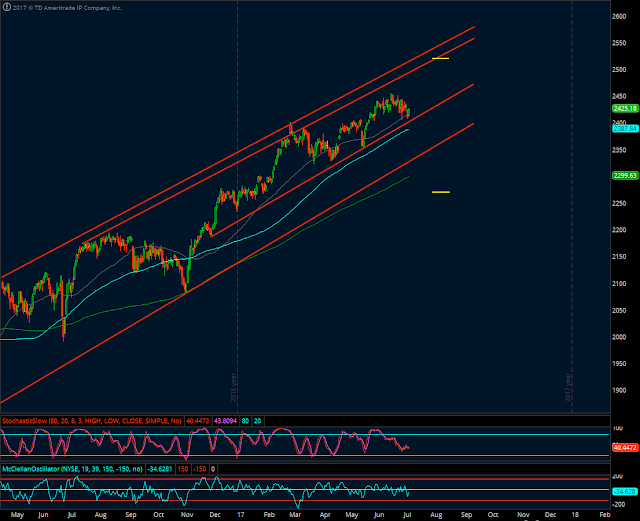

(Click on image to enlarge)

Stochastics: 40 (Neutral. Down from 44 last week)

McClellan: -34 (Neutral. Down from -1 last week)

Stocks above their 20 DMA: 52% (Neutral. Down from 54% last week)

No man's land.

All three oscillators a little lower again this week. Price almost touched the diagonal support line in the middle of the channel. Given how price action has been this entire year, I'm inclined to believe that was it for now and a little rebound is under way. But, what do I know. That's just my bias. On the other hand, if the diagonal support line is broken, the next support I'd be looking at is a horizontal one at the previous swing lows in the SPX 2355 - 2360 neighborhood. That would be a short-term oversold market and an attractive one for selling out of the money Credit Put spreads. Despite the weakness in recent weeks, price has barely retraced from all-time highs, and the VIX continues to have a really hard time going above 12.

With two positions in the August cycle already I'm not looking to add there. But if I only had one on, the next position would have to be a neutral trade and preferably an Elephant due to the fact that the markets are trading around the 50-day average and consequently they have good room to run to the upside, which would hurt an Iron Condor way more.

The Russell 2000:

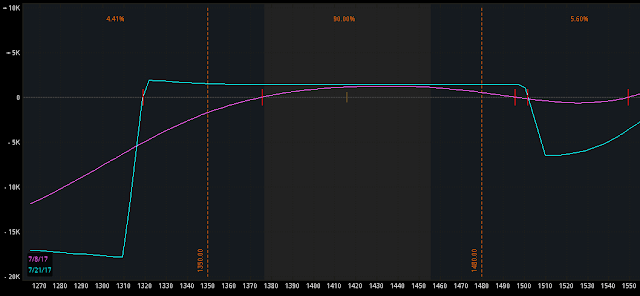

(Click on image to enlarge)

Pretty range bound and "organized" this year with plenty of sideways action. Still looking at potential resistance for RUT at 1440 and first major support in the 1350-1365 zone. The Elephants are currently deployed in the Russell index, one in the July expiration cycle and the other one in the August expiration cycle. Both safe for now.

Current Portfolio

JUL RUT/IWM 1310/1320/1500/1510/134/151 Unbalanced Elephant

Net Credit: $1,417. Two weeks to expiration.

The position is looking great. The Put side comfortable at 5 deltas, the Call side at 2 deltas (although in Elephants we do not defend the Call side based on the 30-delta rule, but still, this illustrates how safe the position is looking).

(Click on image to enlarge)

Defense lines: 1,350 to the downside (adjust the Credit Put spread to the new 10-delta strike price), 1,480 to the upside (close all the Call options for a loss, no adjustments, just keep riding the Credit PUT spreads side).

AUG SPX 2260/2270/2520/2530 Unbalanced Iron Condor

Net Credit: $1,500 and 6 weeks to expiration. Feeling comfortable: Call side at the 4-delta mark, Put side at the 10-delta mark. Both improved since last week.

Adjustment points 2,340 and 2,515 for now.

AUG RUT/IWM 1290/1300/1490/1500/132/150 Unbalanced Elephant

Net Credit: $1,418. Six weeks to expiration.

This position was initiated yesterday, it is obviously safe for now and with some baby-sitting ahead.

(Click on image to enlarge)

Defense lines: 1,350 to the downside (adjust the Credit Put spread to the new 10-delta strike price), 1,455 to the upside (close all the Call options for a loss, no adjustments, just keep riding the Credit PUT spreads side).

Both the July and the August Unbalanced Elephant have the same adjustment point to the downside (RUT 1,350). Not the ideal scenario. Normally I would close the July one, which has accumulated plenty of profits. Certainly something you can do. However, I will keep holding the July one because being much closer to expiration, its adjustment point will move lower at a faster speed (it may be 1340 or even lower by this time next week). So, I'm going to hold both for now.

JUL RUT/IWM 1310/1320/1500/1510/134/151 Unbalanced Elephant

Net Credit: $1,417. Two weeks to expiration.

The position is looking great. The Put side comfortable at 5 deltas, the Call side at 2 deltas (although in Elephants we do not defend the Call side based on the 30-delta rule, but still, this illustrates how safe the position is looking).

(Click on image to enlarge)

Defense lines: 1,350 to the downside (adjust the Credit Put spread to the new 10-delta strike price), 1,480 to the upside (close all the Call options for a loss, no adjustments, just keep riding the Credit PUT spreads side).

AUG SPX 2260/2270/2520/2530 Unbalanced Iron Condor

Net Credit: $1,500 and 6 weeks to expiration. Feeling comfortable: Call side at the 4-delta mark, Put side at the 10-delta mark. Both improved since last week.

Adjustment points 2,340 and 2,515 for now.

AUG RUT/IWM 1290/1300/1490/1500/132/150 Unbalanced Elephant

Net Credit: $1,418. Six weeks to expiration.

This position was initiated yesterday, it is obviously safe for now and with some baby-sitting ahead.

(Click on image to enlarge)

Defense lines: 1,350 to the downside (adjust the Credit Put spread to the new 10-delta strike price), 1,455 to the upside (close all the Call options for a loss, no adjustments, just keep riding the Credit PUT spreads side).

Both the July and the August Unbalanced Elephant have the same adjustment point to the downside (RUT 1,350). Not the ideal scenario. Normally I would close the July one, which has accumulated plenty of profits. Certainly something you can do. However, I will keep holding the July one because being much closer to expiration, its adjustment point will move lower at a faster speed (it may be 1340 or even lower by this time next week). So, I'm going to hold both for now.

Action Plan for the Week

- Keep riding the July RUT Unbalanced Elephant. Only adjust the Put side if the index falls to roughly 1,350. I'd be taking the 1320/1310 Credit Put spreads off the table at a loss and deploying new ones around 1,270 or lower (the presumed new 10-delta mark). To the upside, close all the Call options of the Elephant on a RUT trip to 1,480. No adjustments. The loss would be smaller than the Credit collected from the Put side. I believe both scenarios are unlikely to happen this week.

- Regarding the August SPX Unbalanced Iron Condor, adjust the 2270/2260 Put side if SPX falls to 2,340. Close the 2520/2530 Call side for 0.10 debit if possible, opening the door to possibly redeploying it on a market rebound.

- As for the August RUT Unbalanced Lazy, as mentioned earlier, 1,350 is the adjustment point to the downside. Close Put spread for a loss, deploy new one around the low 1,200's. To the upside, close all the Calls for a loss if RUT reaches 1,455. No adjustment in this case.

- As for new positions, we now go back to waiting mode, expecting the market to reach that elusive oversold environment that it has never reached this year, to see if we can deploy attractive Out of the Money Credit Put spreads. In all likelihood I would choose SPX, and may have to go to September expiration. If no oversold environment is reached over the next two weeks, then we'll start trading the September cycle via an Unbalanced Iron Condor as usual.

Economic Calendar

Monday: China's CPI

Thursday: US PPI & Federal Budget Balance.

Friday: Core CPI, Core Retail Sales, Industrial Production, Michigan Consumer Sentiment.

Take it easy folks.

Have a nice trading week!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2017 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment