Recent Trading Activity

- No Activity

- No Activity

Market Conditions

(Click on image to enlarge)

Stochastics: 94 (Overbought. Up from 40 last week)

McClellan: +88 (Neutral. Up from -34 last week)

Stocks above their 20 DMA: 63% (Neutral. Up from 52% last week)

No man's land.

"Given how price action has been this entire year, I'm inclined to believe that was it for now and a little rebound is under way." - This was a comment I made last week just based on what the year has been. Although I try to be as mechanical as possible without letting my bias cloud my judgement, we always have an inclination, call it gut feeling perhaps(?) after seeing the same behaviors over and over again. I think I might as well extend the whole uptrend channel until year end from now. Very organized price action, new all-time highs, VIX below ten. Markets back to its usual 2017 mood.

SPX price is less than 2% higher than its 50-day average. This leaves some more upside room to this rally before the next 'digestion'. Perhaps a 1% - 2% push higher.

By Friday this week, we'll be 8 weeks away from regular September expiration. Being in no man's land territory my go to play will be an SPX Unbalanced Iron Condor. If we reach an overbought condition, I will still play an Unbalanced Iron Condor, only perhaps using more Calls than usual (2/3 ratio of Calls to Puts, or even 3/4 ratio depending on how far up this thing goes before I enter the position)

The Russell 2000:

(Click on image to enlarge)

RUT has been pretty range bound and "organized" this year. Now close to long-term resistance situated around 1,442 this week. We'll see if it manages to break it. The two Elephant positions are safe, and even if RUT goes to the moon, you know the drill, Elephants were designed to not suffer too much on the way up and still deliver winning results. So, a RUT rally is the least of my concerns.

Current Portfolio

JUL RUT/IWM 1310/1320/1500/1510/134/151 Unbalanced Elephant

Net Credit: $1,417. One week to expiration.

(Click on image to enlarge)

Will expire for max profit this week. We're very unlikely to see any drama here.

AUG SPX 2260/2270/2520/2530 Unbalanced Iron Condor

Net Credit: $1,500 and 5 weeks to expiration. Call side at the 9-delta mark, Put side at the 5-delta mark.

Adjustment point to the downside: 2,330. To the upside, given that a small ratio of 1/4 Calls to Puts is played, I'm willing to wait for the Call side to reach 45 - 48 deltas. Roughly 2,515. At that point I'd me making an adjustment to the new 10-delta Calls.

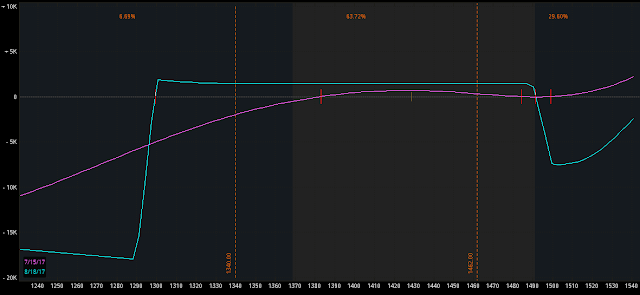

AUG RUT/IWM 1290/1300/1490/1500/132/150 Unbalanced Elephant

Net Credit: $1,418. Five weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,340 to the downside (adjust the Credit Put spread to the new 10-delta strike price), 1,462 to the upside (close all the Call options for a loss, no adjustments, just keep riding the Credit PUT spreads side).

JUL RUT/IWM 1310/1320/1500/1510/134/151 Unbalanced Elephant

Net Credit: $1,417. One week to expiration.

(Click on image to enlarge)

Will expire for max profit this week. We're very unlikely to see any drama here.

AUG SPX 2260/2270/2520/2530 Unbalanced Iron Condor

Net Credit: $1,500 and 5 weeks to expiration. Call side at the 9-delta mark, Put side at the 5-delta mark.

Adjustment point to the downside: 2,330. To the upside, given that a small ratio of 1/4 Calls to Puts is played, I'm willing to wait for the Call side to reach 45 - 48 deltas. Roughly 2,515. At that point I'd me making an adjustment to the new 10-delta Calls.

AUG RUT/IWM 1290/1300/1490/1500/132/150 Unbalanced Elephant

Net Credit: $1,418. Five weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,340 to the downside (adjust the Credit Put spread to the new 10-delta strike price), 1,462 to the upside (close all the Call options for a loss, no adjustments, just keep riding the Credit PUT spreads side).

Action Plan for the Week

- Let the July RUT Unbalanced Elephant expire for max profit.

- August SPX Unbalanced Iron Condor: Adjust the 2520/2530 Call side if SPX reaches 2,515 (unlikely move for just a week). If SPX price pulls back close the spread for 0.10 debit if possible.

- August RUT Unbalanced Lazy: 1,340 is the adjustment point to the downside. Close Put spread for a loss, deploy new one around the low 1,200's. To the upside, close all the Calls for a loss if RUT reaches 1,462 roughly. No adjustment in this case.

- As for new positions, we waited for the oversold condition and it never showed up. But it is almost time to deploy new capital. I'll initiate the first September position by Thursday or Friday. It will be an Unbalanced Elephant. Right now the candidate strike prices are: 2280/2290/2545/2555. Of course, these numbers may change depending on market price action throughout the week, but roughly the usual idea of deploying each side around the 10-delta mark. Sometimes 11 deltas, sometimes 12 (Especially on the Put side) and always looking for the most liquid strike prices (higher Volume and Open Interest). In all likelihood I will be playing the position with a 1/4 ratio of Calls to Puts again. Unless we rally hard early in the week and the 10-delta mark is situated around SPX 2,560 or higher, then I'll consider the usual 1/2 ratio or even 2/3, 3/4.

Economic Calendar

Sunday: China's GDP and Industrial Production.

Monday: Europe's CPI.

Tuesday: German ZEW Economic Sentiment.

Wednesday: US Building Permits, Crude Oil Inventories. Bank of Japan's Monetary Policy Statement and Economic Outlook.

Thursday: US Philly Fed. Bank of Japan press conference. European Central Bank press conference.

Take it easy my friends.

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2017 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment