Initial trade entered on December 5, 2012 selling RUT 870/875 Credit Call spread for 0.70 credit.

Adjusted today when RUT hit 868 in the morning a few minutes after market open.

BUY TO CLOSE 5 RUT 870 Jan. 2013 CALL @12.07 (Initially sold for 3.30)

SELL TO CLOSE 5 RUT 875 Jan. 2013 CALL @9.37 (Initially bought for 2.60)

Debit 2.70

Initial credit obtained was 0.70.

So, the loss on this position was 2.00 debit. On 5 contracts per leg, that's exactly $1000.

Adjustment

SELL 5 RUT 890 Feb. 2013 CALL (@10.35)

BUY 5 RUT 895 Feb. 2013 CALL (@8.55)

Credit: $1.80 (1.80 * 100 * 5 = $900)

Margin: $3.20 (3.20 * 100 * 5 = $1600)

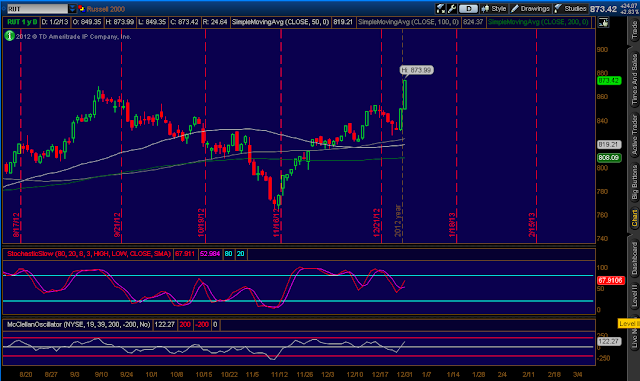

RUT Chart at market close on January 2, 2013 for future reference:

(Click on image to enlarge)

With a bullish candle like the one today, chances are for a continuation in the short term (rest of this week). However, with 86.61% of stocks above their 20 SMA and 80.93% above their 50 SMA, the market is very likely to trade sideways soon or digest the recent moves with a pullback (most likely next week).

Check out Track Record for 2013

Related Articles

Weekend Portfolio Analysis (01-05-2013)

Weekend Portfolio Analysis (01-12-2013)

Weekend Portfolio Analysis (01-19-2013)

Adjusted today when RUT hit 868 in the morning a few minutes after market open.

BUY TO CLOSE 5 RUT 870 Jan. 2013 CALL @12.07 (Initially sold for 3.30)

SELL TO CLOSE 5 RUT 875 Jan. 2013 CALL @9.37 (Initially bought for 2.60)

Debit 2.70

Initial credit obtained was 0.70.

So, the loss on this position was 2.00 debit. On 5 contracts per leg, that's exactly $1000.

Adjustment

SELL 5 RUT 890 Feb. 2013 CALL (@10.35)

BUY 5 RUT 895 Feb. 2013 CALL (@8.55)

Credit: $1.80 (1.80 * 100 * 5 = $900)

Margin: $3.20 (3.20 * 100 * 5 = $1600)

RUT Chart at market close on January 2, 2013 for future reference:

(Click on image to enlarge)

With a bullish candle like the one today, chances are for a continuation in the short term (rest of this week). However, with 86.61% of stocks above their 20 SMA and 80.93% above their 50 SMA, the market is very likely to trade sideways soon or digest the recent moves with a pullback (most likely next week).

Check out Track Record for 2013

Related Articles

Weekend Portfolio Analysis (01-05-2013)

Weekend Portfolio Analysis (01-12-2013)

Weekend Portfolio Analysis (01-19-2013)

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment