Market up 2.7% this week and 10.5% since the February 11 lows. Quite a rally when people least expected it, as usual, yet when it made sense to go long and stop betting on cataclysm. The market is now down only 2.17% for the year, and we are in the type of environment (sustained and strong index rally) where the worthiness of any active trading strategy is constantly put into question. Time to be extra careful folks

Market Conditions

(Click on image to enlarge)

Stochastics: 97 (overbought)

Recent Trading Activity

- No activity

- No activity

Market Conditions

(Click on image to enlarge)

Stochastics: 97 (overbought)

McClellan: +323 (overbought)

Stocks above their 20 DMA: 89% (overbought)

A short-term overbought extreme.

In spite of this "overboughtness", I haven't sold Credit Call spreads. When we are still far below the 200 DMA, I just prefer to be extra cautious. Only 35% of stocks trading above their respective 200 DMAs, which is still a historically low number. If I were to sell new Credit Call spreads here, I would choose SPX, as the Russell is farther away from its 200 DMA, whereas with SPX you can start selling OTM Credit Call spreads above the all time highs for decent credits. I would also trade smaller than usual.

Technically speaking, if 2016 is really part of the beginning of a bear market, a notion not being mentioned anymore, I would expect that descending line to offer some resistance this upcoming week. Curiously, it is also near the 200 DMA of the index, a level which a lot of people are going to be looking at. I think we have gone too far too fast and odds are this move will be digested via price action or at least time (sideways action for a while), but of course, the beast will do as it pleases.

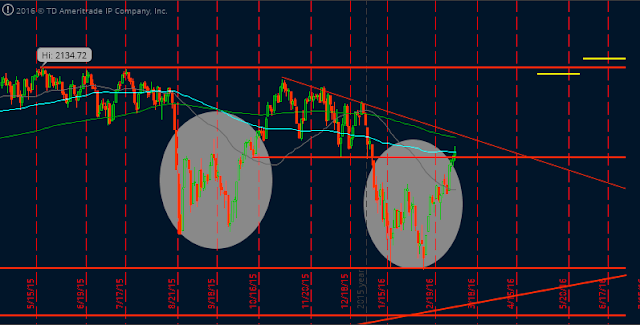

This price action is very similar to that of "Late August - Mid October" last year. If you look at the chart, there are two "W" formations that look almost identical.

(Click on image to enlarge)

In the 2015 case, the final rebound was a 245 point move (1,871 to 2,116). It was a phenomenal 13% rally that lasted one month and a week. A similar rally this time around, would take us to 2,055 and more than 6% above the 50 DMA which is typically a stretch.

In the case of Russell

(Click on image to enlarge)

I have no positions in Russell and that yellow line on the right is where I would like to deploy one (1210). I was trying to get filled on a 1210/1220 June30 CCs for 1.00 credit on Friday but never got a fill. Minor resistance at 1,080 temporarily stopped the RUT on its unstoppable ride. We'll see if it holds. The Russell was my candidate for new Credit Put spreads when there was extreme pessimism, but not my favorite for Credit Call spreads. I'm just loaded on SPX.

Today, I have extended the technical analysis section more than usual because I think it is really really important to not get hurt shorting Calls. If there is one thing we have learned over the years as Credit Spread traders, it is to be more conservative when selling Credit Call spreads. Distances suck, premiums suck, adjustments suck. It is crucial to play them smaller than the Put spreads. There is no sin in waiting longer either. On the other hand, a Credit Put spread gone badly, is like "who cares??!!, the market is falling like a fly and therefore I would be worse off passively investing in the index". You always have that "excuse" with the Put side, plus your adjustments are much nicer and safer, always. Call side? a totally different animal.

Action Plan for the Week

- Adjust May and June unbalanced Iron Condors if SPX reaches 2,055 and 2,070 respectively.

- Possibly initiate a June30 RUT 1210/1220 Credit Call spread position for 1.00 or better if there is a chance. Or I may even be happier with 1220/1230 for 0.90 or so. Half the size on this bet.

-With a VIX currently below 17, it is a better time to start thinking about buying cheaper portfolio insurance for future Credit Put spread positions. July 150 strike SPY Puts for those who like 5 deltas or 165 for those who prefer 10 deltas. I may go with 165 this time.

Forex

Long Gold (XAU/USD) via LT Trend Sniper robot at 1,261.10. I had some difficulties with the configuration of the Sniper and the trade was entered 30 something minutes after the open, so my price is not exactly the same as the open of the candle.

Economic Calendar

Tuesday: Europe GDP

Wednesday: US Crude Oil Inventories

Thursday: Federal Budget Balance

Options Trading results - With closed positions and trading costs included, we are down 2.26% for 2016 while the market is down 2.17%. The portfolio is currently 36% at risk, 64% in cash.

Forex Trading results - Up +4.36% for the year. Long Gold at the moment.

Good luck this week folks!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2016 Track Record

Go to the bottom of this page in order to see the Legal Stuff

Stocks above their 20 DMA: 89% (overbought)

A short-term overbought extreme.

In spite of this "overboughtness", I haven't sold Credit Call spreads. When we are still far below the 200 DMA, I just prefer to be extra cautious. Only 35% of stocks trading above their respective 200 DMAs, which is still a historically low number. If I were to sell new Credit Call spreads here, I would choose SPX, as the Russell is farther away from its 200 DMA, whereas with SPX you can start selling OTM Credit Call spreads above the all time highs for decent credits. I would also trade smaller than usual.

Technically speaking, if 2016 is really part of the beginning of a bear market, a notion not being mentioned anymore, I would expect that descending line to offer some resistance this upcoming week. Curiously, it is also near the 200 DMA of the index, a level which a lot of people are going to be looking at. I think we have gone too far too fast and odds are this move will be digested via price action or at least time (sideways action for a while), but of course, the beast will do as it pleases.

This price action is very similar to that of "Late August - Mid October" last year. If you look at the chart, there are two "W" formations that look almost identical.

(Click on image to enlarge)

In the 2015 case, the final rebound was a 245 point move (1,871 to 2,116). It was a phenomenal 13% rally that lasted one month and a week. A similar rally this time around, would take us to 2,055 and more than 6% above the 50 DMA which is typically a stretch.

In the case of Russell

(Click on image to enlarge)

I have no positions in Russell and that yellow line on the right is where I would like to deploy one (1210). I was trying to get filled on a 1210/1220 June30 CCs for 1.00 credit on Friday but never got a fill. Minor resistance at 1,080 temporarily stopped the RUT on its unstoppable ride. We'll see if it holds. The Russell was my candidate for new Credit Put spreads when there was extreme pessimism, but not my favorite for Credit Call spreads. I'm just loaded on SPX.

Today, I have extended the technical analysis section more than usual because I think it is really really important to not get hurt shorting Calls. If there is one thing we have learned over the years as Credit Spread traders, it is to be more conservative when selling Credit Call spreads. Distances suck, premiums suck, adjustments suck. It is crucial to play them smaller than the Put spreads. There is no sin in waiting longer either. On the other hand, a Credit Put spread gone badly, is like "who cares??!!, the market is falling like a fly and therefore I would be worse off passively investing in the index". You always have that "excuse" with the Put side, plus your adjustments are much nicer and safer, always. Call side? a totally different animal.

Current Portfolio

March IWM 112/112/120 Synthetic Stock Hedged

I will close it this week or next for a full loss. Didn't work. Time to move on. Small bet anyways.

May31 SPX 1475/1500 Credit Put Spread

$1,560 credit. 3 deltas. Will close it for 0.40 debit given the opportunity. It may happen this week.

May31 SPX 2125/2150 Credit Call Spread

14 deltas at the moment. Taking a little hit, but there is still some room. Adjustment condition around 2,055 for this week. I think it won't happen, but if it does, I will deploy a 2175/2200 or 2200/2250 with full position size to compensate.

June30 SPX 1500/1525/2150/2175 Unbalanced Iron Condor

5 deltas on the Put side at the moment and 14 on the Calls. Adjustment point for the week estimated at around 2,070. I believe we won't see this number, but if we do, I will deploy a new 2225/2250 using full size. I'm glad both Iron Condors I have in play are unbalanced.

March IWM 112/112/120 Synthetic Stock Hedged

I will close it this week or next for a full loss. Didn't work. Time to move on. Small bet anyways.

May31 SPX 1475/1500 Credit Put Spread

$1,560 credit. 3 deltas. Will close it for 0.40 debit given the opportunity. It may happen this week.

May31 SPX 2125/2150 Credit Call Spread

14 deltas at the moment. Taking a little hit, but there is still some room. Adjustment condition around 2,055 for this week. I think it won't happen, but if it does, I will deploy a 2175/2200 or 2200/2250 with full position size to compensate.

June30 SPX 1500/1525/2150/2175 Unbalanced Iron Condor

5 deltas on the Put side at the moment and 14 on the Calls. Adjustment point for the week estimated at around 2,070. I believe we won't see this number, but if we do, I will deploy a new 2225/2250 using full size. I'm glad both Iron Condors I have in play are unbalanced.

Action Plan for the Week

- Adjust May and June unbalanced Iron Condors if SPX reaches 2,055 and 2,070 respectively.

- Possibly initiate a June30 RUT 1210/1220 Credit Call spread position for 1.00 or better if there is a chance. Or I may even be happier with 1220/1230 for 0.90 or so. Half the size on this bet.

-With a VIX currently below 17, it is a better time to start thinking about buying cheaper portfolio insurance for future Credit Put spread positions. July 150 strike SPY Puts for those who like 5 deltas or 165 for those who prefer 10 deltas. I may go with 165 this time.

Forex

Long Gold (XAU/USD) via LT Trend Sniper robot at 1,261.10. I had some difficulties with the configuration of the Sniper and the trade was entered 30 something minutes after the open, so my price is not exactly the same as the open of the candle.

Economic Calendar

Tuesday: Europe GDP

Wednesday: US Crude Oil Inventories

Thursday: Federal Budget Balance

Options Trading results - With closed positions and trading costs included, we are down 2.26% for 2016 while the market is down 2.17%. The portfolio is currently 36% at risk, 64% in cash.

Forex Trading results - Up +4.36% for the year. Long Gold at the moment.

Good luck this week folks!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2016 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment