Trade Details:

4 May SPX 2600/2590 Credit Put spread @0.65 credit each

2 May SPX 2960/2970 Credit Call spread @1.00 credit each

2 May SPY 297 Long Calls @0.50 debit each

Net Credit: $360

Max Risk: $3,640

Profit/Risk Profile

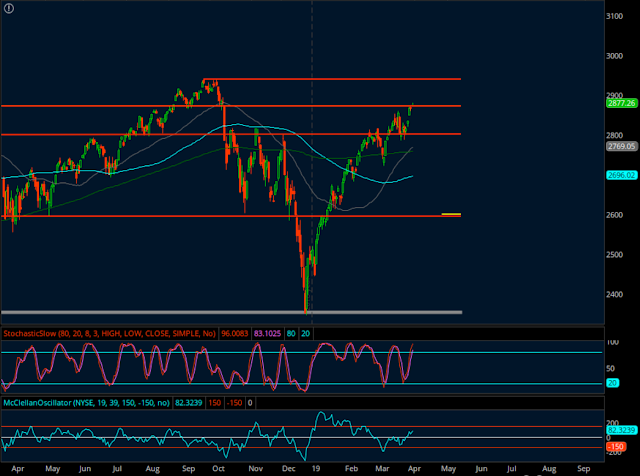

SPX Chart for future reference:

Trade Update - April 3, 2019

Taking off the Call side at a small loss as the market keeps rallying

4 May SPX 2600/2590 Credit Put spread @0.65 credit each

2 May SPX 2960/2970 Credit Call spread @1.00 credit each

2 May SPY 297 Long Calls @0.50 debit each

Net Credit: $360

Max Risk: $3,640

Profit/Risk Profile

SPX Chart for future reference:

Trade Update - April 3, 2019

Taking off the Call side at a small loss as the market keeps rallying

Closed 2 May SPX 2960/2970 Credit Call spread @2.25 debit each

Loss 1.25 per. $250 for two spreads in dollar terms.

Closed 2 May SPY 297 Long Calls @0.99 credit each

Gain 0.49 per. $98 for 2 contracts.

Loss 1.25 per. $250 for two spreads in dollar terms.

Closed 2 May SPY 297 Long Calls @0.99 credit each

Gain 0.49 per. $98 for 2 contracts.

Net Loss combining both things is +$98 - $250 = -$152

The Put side 2600/2590 remains in place with its $260 credit.

Trade Update - April 16, 2019

Closed 4 May SPX 2600/2590 Credit Put spread @0.10 debit each

Original Credit: 0.65

Net Profit: 0.55, which is $220 in dollar terms for 4 spreads.

Combining this $220 profit with the earlier $152 loss on the Call side, there is a net $68 profit.

On a $3640 risk, this is a small +1.9% Return on Risk.

Trade Update - April 16, 2019

Closed 4 May SPX 2600/2590 Credit Put spread @0.10 debit each

Original Credit: 0.65

Net Profit: 0.55, which is $220 in dollar terms for 4 spreads.

Combining this $220 profit with the earlier $152 loss on the Call side, there is a net $68 profit.

On a $3640 risk, this is a small +1.9% Return on Risk.

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment