Recent Trading Activity

Market Conditions

(Click on image to enlarge)

Stochastics: 88 (Overbought. Up from 81)

McClellan: -12 (Neutral. Up from -35)

Stocks above their 20 DMA: 49% (Neutral. Up from 44%)

No man's land

New all-time highs but neutral territory, which leaves more room. I think we are not at a short-term overbought extreme yet. The number of stocks trading above their 20-day avg is suspiciously low for an index that is now 2.5% above its 50-day average. Although it is No man's land, and although I've been carrying a bullish bias for most of the year, the upside starts to look more limited in the short term now. Oscillators still have some decent room to move up, but with the index already 2.5% above its 50-day, further upside starts to become unlikely without some sideways action or small sell-off first. A one percent move higher would start to feel extreme. So, around 2,950. At that point, old resistance may offer support (2,915 first, and around 2,870 later).

With three positions at the moment, I have no plans to add another one. But had I been underexposed, willing to deploy capital, my go to play would be a neutral one, as usual when in No man's land condition.

The Russell Index:

(Click on image to enlarge)

A little far from all-time highs. That zone around 1745 should offer some decent resistance. If we get there this week, the S&P will be nearing short-term extreme territory, and that wouldn't help the overall markets. To the downside, only minor support spots, and the more significant one coming into play in the low 1600's. Which doesn't seem likely at all for this upcoming week of market action.

Action Plan for the Week

- I may be able to close the Call side of the October RUT Elephant for around $300 profit or better. I'd like to be able to take 75% or more from its potential max profit of $360.

- Other than that, this week will just be about baby-sitting the positions and keeping an eye on the potential need for a defensive move around the defense lines detailed earlier.

Economic Calendar

Tuesday: CB Consumer Confidence.

Wednesday: US New Home Sales. FOMC Economic Projections, Interest Rate Decision.

Thursday: US GDP, Core Durable Goods, Pending Home Sales.

Friday: Europe CPI. Chicago PMI. Michigan Consumer Sentiment.

Good luck this week my friends!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

- The September SPX Elephant Put side expired on Friday for a $1,078 profit.

- Initiated a November RUT Elephant on Friday for $1,470 credit.

- Initiated a November RUT Elephant on Friday for $1,470 credit.

Market Conditions

(Click on image to enlarge)

Stochastics: 88 (Overbought. Up from 81)

McClellan: -12 (Neutral. Up from -35)

Stocks above their 20 DMA: 49% (Neutral. Up from 44%)

No man's land

New all-time highs but neutral territory, which leaves more room. I think we are not at a short-term overbought extreme yet. The number of stocks trading above their 20-day avg is suspiciously low for an index that is now 2.5% above its 50-day average. Although it is No man's land, and although I've been carrying a bullish bias for most of the year, the upside starts to look more limited in the short term now. Oscillators still have some decent room to move up, but with the index already 2.5% above its 50-day, further upside starts to become unlikely without some sideways action or small sell-off first. A one percent move higher would start to feel extreme. So, around 2,950. At that point, old resistance may offer support (2,915 first, and around 2,870 later).

With three positions at the moment, I have no plans to add another one. But had I been underexposed, willing to deploy capital, my go to play would be a neutral one, as usual when in No man's land condition.

The Russell Index:

(Click on image to enlarge)

A little far from all-time highs. That zone around 1745 should offer some decent resistance. If we get there this week, the S&P will be nearing short-term extreme territory, and that wouldn't help the overall markets. To the downside, only minor support spots, and the more significant one coming into play in the low 1600's. Which doesn't seem likely at all for this upcoming week of market action.

Current Portfolio:

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Oct SPX/SPY - 2690/2700/3010/3020 - 274/302 Elephant

Net Credit: $1448. Four weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,760 to the downside (adjust Put side). 2,975 to the upside (close entire Call side at a loss. Keep riding Put side). The Call side lost some of the profits it had made, but it is still far from needing to be closed.

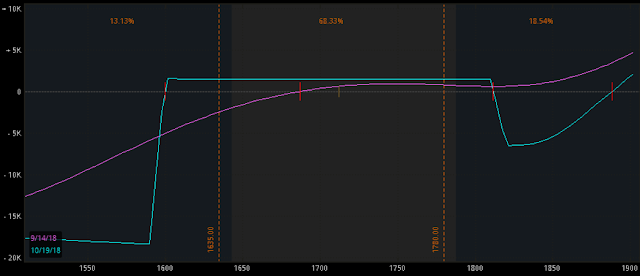

Oct RUT/IWM - 1590/1600/1810/1820 - 161/182 Elephant

Net Credit: $1463. Four weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,635 to the downside (adjust Put side). 1,780 to the upside (close entire Call side at a loss. Keep riding Put side). There is some nice profit on the Call side and I'll attempt to close it for 75% or more than its max potential profit.

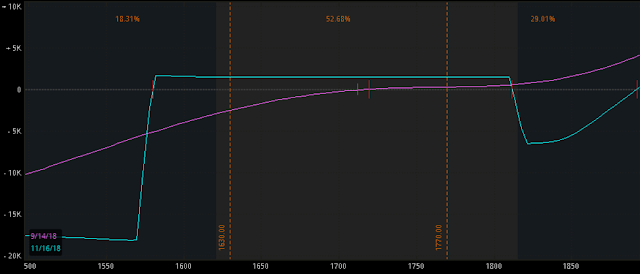

Nov RUT/IWM - 1570/1580/1810/1820 - 161/182 Elephant

Net Credit: $1470. Eight weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,630 to the downside (adjust Put side). 1,770 to the upside (close entire Call side at a loss. Keep riding Put side). The new position initiated a few hours ago. Obviously far from threats for now and unlikely to need any defensive move this week.

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Oct SPX/SPY - 2690/2700/3010/3020 - 274/302 Elephant

Net Credit: $1448. Four weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,760 to the downside (adjust Put side). 2,975 to the upside (close entire Call side at a loss. Keep riding Put side). The Call side lost some of the profits it had made, but it is still far from needing to be closed.

Oct RUT/IWM - 1590/1600/1810/1820 - 161/182 Elephant

Net Credit: $1463. Four weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,635 to the downside (adjust Put side). 1,780 to the upside (close entire Call side at a loss. Keep riding Put side). There is some nice profit on the Call side and I'll attempt to close it for 75% or more than its max potential profit.

Nov RUT/IWM - 1570/1580/1810/1820 - 161/182 Elephant

Net Credit: $1470. Eight weeks to expiration.

(Click on image to enlarge)

Defense lines: 1,630 to the downside (adjust Put side). 1,770 to the upside (close entire Call side at a loss. Keep riding Put side). The new position initiated a few hours ago. Obviously far from threats for now and unlikely to need any defensive move this week.

Action Plan for the Week

- I may be able to close the Call side of the October RUT Elephant for around $300 profit or better. I'd like to be able to take 75% or more from its potential max profit of $360.

- Other than that, this week will just be about baby-sitting the positions and keeping an eye on the potential need for a defensive move around the defense lines detailed earlier.

Economic Calendar

Tuesday: CB Consumer Confidence.

Wednesday: US New Home Sales. FOMC Economic Projections, Interest Rate Decision.

Thursday: US GDP, Core Durable Goods, Pending Home Sales.

Friday: Europe CPI. Chicago PMI. Michigan Consumer Sentiment.

Good luck this week my friends!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment