Recent Trading Activity

(Click on image to enlarge)

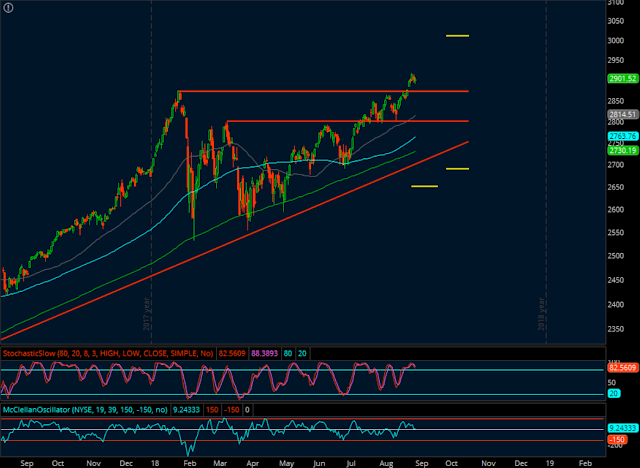

Stochastics: 82 (Overbought. Down from 86)

McClellan: +9 (Neutral. Up from +71)

Stocks above their 20 DMA: 62% (Neutral. Down from 63%)

No man's land

The market is almost 1% higher than the previous weekend, yet all three oscillators are lower. This signals a bearish divergence which has started to pan out as evidenced by the price of the index falling a little from the Wednesday highs. The index is also 3.1% higher than its 50-day average at the moment. It reached an extreme 3.5% on Wednesday. Now there is a little room again, but I think the up move is limited for now. Bullish exuberance is extremely hard to extinguish, and markets don't crash from all-time highs. So, to me, some sideways action is in the cards for a few days. We'll see. In any case, biases aside, No man's land simply tells us one thing: Play neutral. Do not expose your self with a Credit Call spread or with a Credit Put spread.

The Russell Index:

(Click on image to enlarge)

RUT Much stronger than the SPX and also 3.1% higher than its 50-day. Unlike SPX, RUT shoots 5-6% above the 50-day average with frequency. So, although overall, I am biased towards some sideways action in the upcoming days, I leave room for the fact that RUT is a wilder beast to the upside. Caution should be exercised on the Call side of the September RUT Elephant.

Action Plan for the Week

- Deploy the second position of the October cycle. Because we are far from oversold (which would imply a Credit Put spread), I am going with a RUT Elephant, following the usual Elephant guidelines. The position will be initiated in the second half of the week.

- Because of the idea mentioned above, I would be carrying four positions at the same time (2 in the Sept cycle and 2 in the Oct cycle). That's too much exposure that I don't desire. So, I intend to get rid of one of the September positions. Most likely the Sept SPX Elephant Put side (which is the only side that remains from that Elephant). But really, the Sept RUT Elephant can also be considered. Either one is fine as long as one is removed from the portfolio.

- Other than that, just baby-sit positions and defend at the specified levels. The Call side of the Sept RUT Elephant is the one more likely to need a defense, with the Russell only 30 points away from the 1,770 defense line.

Economic Calendar

Monday: US Markets closed on Labor Day

Tuesday: US Manufacturing PMI & Employment.

Wednesday: US Exports/Imports. Some FOMC members speak.

Thursday: ADP Non-Farm Employment Change. ISM Non-Manufacturing PMI & Employment.

Friday: US Non-Farm Payrolls. Unemployment Rate. Some FOMC Members will speak.

Good luck this week my friends!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

- Initiated an October SPX Elephant on Monday. Net credit $1,448.

- Added a new Call side to the RUT Elephant Put side on Monday. Back to a full Elephant position. The original Call side on the September RUT Elephant had been taken off for profits a couple of weeks ago. The new Call side recently deployed brought a new credit of $363.

- Closed Call side of September SPX Elephant on Monday at a $1,098 loss. The market gap up didn't help and I ended up closing it when the SPX was trading around 2,893. Way beyond the proposed defense line of 2,885.

Market Conditions- Added a new Call side to the RUT Elephant Put side on Monday. Back to a full Elephant position. The original Call side on the September RUT Elephant had been taken off for profits a couple of weeks ago. The new Call side recently deployed brought a new credit of $363.

- Closed Call side of September SPX Elephant on Monday at a $1,098 loss. The market gap up didn't help and I ended up closing it when the SPX was trading around 2,893. Way beyond the proposed defense line of 2,885.

(Click on image to enlarge)

Stochastics: 82 (Overbought. Down from 86)

McClellan: +9 (Neutral. Up from +71)

Stocks above their 20 DMA: 62% (Neutral. Down from 63%)

No man's land

The market is almost 1% higher than the previous weekend, yet all three oscillators are lower. This signals a bearish divergence which has started to pan out as evidenced by the price of the index falling a little from the Wednesday highs. The index is also 3.1% higher than its 50-day average at the moment. It reached an extreme 3.5% on Wednesday. Now there is a little room again, but I think the up move is limited for now. Bullish exuberance is extremely hard to extinguish, and markets don't crash from all-time highs. So, to me, some sideways action is in the cards for a few days. We'll see. In any case, biases aside, No man's land simply tells us one thing: Play neutral. Do not expose your self with a Credit Call spread or with a Credit Put spread.

The Russell Index:

(Click on image to enlarge)

RUT Much stronger than the SPX and also 3.1% higher than its 50-day. Unlike SPX, RUT shoots 5-6% above the 50-day average with frequency. So, although overall, I am biased towards some sideways action in the upcoming days, I leave room for the fact that RUT is a wilder beast to the upside. Caution should be exercised on the Call side of the September RUT Elephant.

Current Portfolio:

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Sep RUT/IWM 1530/1540/1795/1800 - 158/180 Elephant

Net Credit: $1459. Three weeks to expiration

(Click on image to enlarge)

Defense lines: 1,575 to the downside (adjust Put side). 1,770 to the upside (close entire Call side at a loss. Keep riding Put side).

Sep SPX/SPY 2645/2650 - 269 Elephant Put side

Net Credit: $1042. Three weeks to expiration

(Click on image to enlarge)

Defense lines: 2,700 to the downside (adjust Put side).

Oct SPX/SPY - 2690/2700/3010/3020 - 274/302 Elephant

Net Credit: $1448. Seven weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,760 to the downside (adjust Put side). 2,960 to the upside (close entire Call side at a loss. Keep riding Put side).

The SPY Calls and SVXY Calls expire in December and January of next year. All bullish bets on a market rebound.

Let's now look at the income plays.

Sep RUT/IWM 1530/1540/1795/1800 - 158/180 Elephant

Net Credit: $1459. Three weeks to expiration

(Click on image to enlarge)

Defense lines: 1,575 to the downside (adjust Put side). 1,770 to the upside (close entire Call side at a loss. Keep riding Put side).

Sep SPX/SPY 2645/2650 - 269 Elephant Put side

Net Credit: $1042. Three weeks to expiration

(Click on image to enlarge)

Defense lines: 2,700 to the downside (adjust Put side).

Oct SPX/SPY - 2690/2700/3010/3020 - 274/302 Elephant

Net Credit: $1448. Seven weeks to expiration.

(Click on image to enlarge)

Defense lines: 2,760 to the downside (adjust Put side). 2,960 to the upside (close entire Call side at a loss. Keep riding Put side).

Action Plan for the Week

- Deploy the second position of the October cycle. Because we are far from oversold (which would imply a Credit Put spread), I am going with a RUT Elephant, following the usual Elephant guidelines. The position will be initiated in the second half of the week.

- Because of the idea mentioned above, I would be carrying four positions at the same time (2 in the Sept cycle and 2 in the Oct cycle). That's too much exposure that I don't desire. So, I intend to get rid of one of the September positions. Most likely the Sept SPX Elephant Put side (which is the only side that remains from that Elephant). But really, the Sept RUT Elephant can also be considered. Either one is fine as long as one is removed from the portfolio.

- Other than that, just baby-sit positions and defend at the specified levels. The Call side of the Sept RUT Elephant is the one more likely to need a defense, with the Russell only 30 points away from the 1,770 defense line.

Economic Calendar

Monday: US Markets closed on Labor Day

Tuesday: US Manufacturing PMI & Employment.

Wednesday: US Exports/Imports. Some FOMC members speak.

Thursday: ADP Non-Farm Employment Change. ISM Non-Manufacturing PMI & Employment.

Friday: US Non-Farm Payrolls. Unemployment Rate. Some FOMC Members will speak.

Good luck this week my friends!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2018 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment