Recent Trading Activity

- August RUT Unbalanced Elephant expired for max profit of +$1,418 on Friday.

- Closed Put side of September RUT Unbalanced Elephant at a loss on Friday. The loss was partially hedged by gains from the long IWM Puts. Net-net it was a $2,748 loss.

- A new 1250/1240 Credit Put spread was deployed in the same RUT as an adjustment, using the same September expiration cycle. Credit Collected: $1,200.

- Closed Credit Call spread of September RUT Unbalanced Elephant for a +$570 gain. Left the IWM Long Calls in. Closing the IWM long Calls would not have made sense as they are almost worthless. Whatever value is left to save (0.01) would be eaten by commissions).

- Purchased December SPY 253 strike price Calls. Small speculative play betting on a rebound. Four months for this play to work. It's a low probability move sure, but it can bring juicy returns if the market rallies before year end.

It was a somewhat unfortunate week with that first loss on Elephant positions. It was a good run of 12 consecutive Elephant winners (4 last year and 8 this year). All the activity was concentrated on Friday. The first half of the week was navigated without damages and I thought that would be it. Then Thursday surprised with more weakness and then some more on Friday morning. Despite the loss on the September Elephant, the other two wins mitigated the damage and overall the portfolio lost only $760 for the week (before commissions), less than 1% of the portfolio. More importantly, current positions look safe and that should be enough to eventually recover from this small setback.

- August RUT Unbalanced Elephant expired for max profit of +$1,418 on Friday.

- Closed Put side of September RUT Unbalanced Elephant at a loss on Friday. The loss was partially hedged by gains from the long IWM Puts. Net-net it was a $2,748 loss.

- A new 1250/1240 Credit Put spread was deployed in the same RUT as an adjustment, using the same September expiration cycle. Credit Collected: $1,200.

- Closed Credit Call spread of September RUT Unbalanced Elephant for a +$570 gain. Left the IWM Long Calls in. Closing the IWM long Calls would not have made sense as they are almost worthless. Whatever value is left to save (0.01) would be eaten by commissions).

- Purchased December SPY 253 strike price Calls. Small speculative play betting on a rebound. Four months for this play to work. It's a low probability move sure, but it can bring juicy returns if the market rallies before year end.

It was a somewhat unfortunate week with that first loss on Elephant positions. It was a good run of 12 consecutive Elephant winners (4 last year and 8 this year). All the activity was concentrated on Friday. The first half of the week was navigated without damages and I thought that would be it. Then Thursday surprised with more weakness and then some more on Friday morning. Despite the loss on the September Elephant, the other two wins mitigated the damage and overall the portfolio lost only $760 for the week (before commissions), less than 1% of the portfolio. More importantly, current positions look safe and that should be enough to eventually recover from this small setback.

Market Conditions

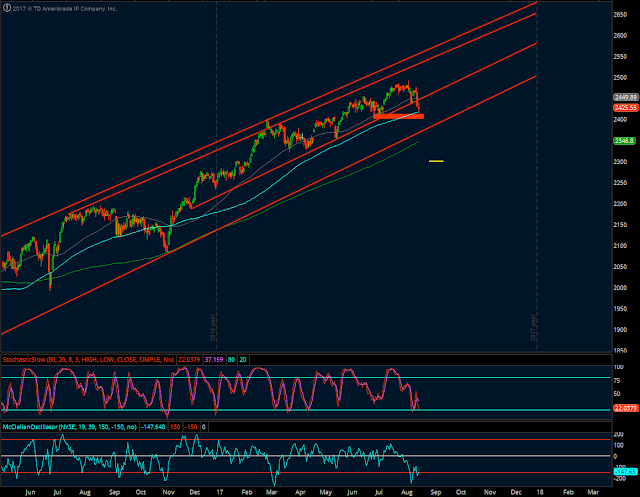

(Click on image to enlarge)

Stochastics: 22 (Neutral. Up from 16 last week)

McClellan: -147 (Neutral. Up from -244 last week)

Stocks above their 20 DMA: 25% (Oversold. Same as last week)

No man's land but very close to an Oversold extreme.

The index is 13 points lower than last week, yet two of the oscillators are higher and the third one at the same level. So, there is an incipient bullish divergence there that could be signaling a temporary bottom. If that fails, I'm seeing the 2,400 - 2,410 region as potential horizontal support. On a longer-term basis the index is still far from its 200-day average, so there is room to fall, but I believe 2,400 - 2,410 should offer decent support short-term. And short-term is mostly what we care about. Below that horizontal support lies the lower end of the longer term uptrend channel, pointing to around 2,380 this week.

The Russell 2000:

(Click on image to enlarge)

Unlike SPX, RUT has been much weaker all year. The small caps are now flat for the year, very close to where they started and the index itself is now below its 200-day moving average. Looking at the big picture, the S&P has barely corrected (roughly 3% from its all-time high), whereas the Russell lost more than 7% in these recent times of weakness. This is the reason why the September RUT Elephant took a loss on the Put side, despite an S&P index that has barely fallen. Had we played the September Elephant with SPX options, no adjustment would have been necessary. But, we can't kid ourselves: had we played Elephants on SPX all year, perhaps we wouldn't have done so well and would have needed to take small Call side losses here and there, while collecting overall less credit too as SPX has been way less volatile.

Potential horizontal support for the Russell around 1,340 and if that fails, then the long term trend support line in the 1,305 - 1,315 region this week. Although I believe Friday's price action was pretty constructive here and a rebound is due, even if small.

Current Portfolio

SEP SPX 2300/2310 Credit Put spread

Net Credit: $1,100. Four weeks to expiration. Remainder of what originally was an Unbalanced Iron Condor. 14 deltas.

(Click on image to enlarge)

Defense line: 2,380.

SEP RUT 1240/1250 Credit Put spread

SEP IWM 148 Long Calls

What is left of the September Elephant.

Net Credit: $840. Four weeks to expiration.

(Click on image to enlarge)

Defense line: 1,290.

OCT RUT 1200/1190 Credit Put spread

Net Credit: $1,200. Nine weeks to expiration. 10 deltas.

(Click on image to enlarge)

Defense line: 1,260.

DEC SPY 253 Calls

3 contracts at 1.50 debit each.

Small bullish speculative play.

I'm not concerned about cutting a loss here or anything. It's an all or nothing kind of play with a small risk of less than 0.5% of the portfolio. The initial plan is to make 100% return on investment. So, I'll place a GTC order to close for 3.00 credit. Alternatively, you can lock in some gains and totally reduce risk in the position on a market rally if you get to sell a higher strike price Call option for 1.50 credit or better. You would effectively be legging into a Bull Call spread where you can still make more gains without the concern of losing money.

For instance, imagine there is an SPX rally of 30 points this week, which is just a bit more than 1%, so pretty realistic. Let's say the December SPY 255 Calls can be sold for 1.60 credit. All of sudden you end up in this position:

With guaranteed gains to the downside and still more upside potential. All at the expense of capping that maximum gain. Details about this technique can be found on page 45 of the LT Options Guide.

SEP SPX 2300/2310 Credit Put spread

Net Credit: $1,100. Four weeks to expiration. Remainder of what originally was an Unbalanced Iron Condor. 14 deltas.

(Click on image to enlarge)

Defense line: 2,380.

SEP RUT 1240/1250 Credit Put spread

SEP IWM 148 Long Calls

What is left of the September Elephant.

Net Credit: $840. Four weeks to expiration.

(Click on image to enlarge)

Defense line: 1,290.

OCT RUT 1200/1190 Credit Put spread

Net Credit: $1,200. Nine weeks to expiration. 10 deltas.

(Click on image to enlarge)

Defense line: 1,260.

DEC SPY 253 Calls

3 contracts at 1.50 debit each.

Small bullish speculative play.

I'm not concerned about cutting a loss here or anything. It's an all or nothing kind of play with a small risk of less than 0.5% of the portfolio. The initial plan is to make 100% return on investment. So, I'll place a GTC order to close for 3.00 credit. Alternatively, you can lock in some gains and totally reduce risk in the position on a market rally if you get to sell a higher strike price Call option for 1.50 credit or better. You would effectively be legging into a Bull Call spread where you can still make more gains without the concern of losing money.

For instance, imagine there is an SPX rally of 30 points this week, which is just a bit more than 1%, so pretty realistic. Let's say the December SPY 255 Calls can be sold for 1.60 credit. All of sudden you end up in this position:

With guaranteed gains to the downside and still more upside potential. All at the expense of capping that maximum gain. Details about this technique can be found on page 45 of the LT Options Guide.

Action Plan for the Week

The portfolio is well positioned for a market rebound with three Credit Put spreads and a long term long Calls play. This also means, that a continued sell-off will hurt. In addition, this week would be the time to add an October SPX Unbalanced Iron Condor, which increases downside exposure. Because of this I will make it a priority to liquidate at least one of the Credit Put spreads for 50% of maximum gain potential.

- Close the October RUT 1200/1190 Credit Put spread for $600 profit if possible (that'd be 0.30 debit each spread). We're nowhere near close, but I'll enter the GTC order. On a sell off, adjust this spread with RUT reaching roughly 1,260.

- Close the September SPX 2310/2300 Credit Put spread for $900 profit whenever possible. That would mean closing each spread for 0.10 debit. Also far from that, but I'll put the GTC order in. On the other hand, adjust if SPX declines to around 2,380 and the 2310 Put reaches 30 deltas.

- Defend September RUT 1250/1240 Credit Call spread with RUT falling to 1,290. On a rally, consider re-establishing a Call side on this position. Maybe a 1460/1470 Credit Call spread for 0.90 credit or better using half the number of contracts or even less.

- Close December SPY Long Calls at 3.00 credit (each) or better.

- On Friday, we will be 8 weeks away from October expiration. If we are in oversold territory, I will go with an SPX Credit Put spread. Strike prices 2,175/2,165 or so. That looks far and comfortable enough. However, that would be quadruple downside exposure and almost asking for trouble, so, I will be inclined to play it with a smaller position size than usual. If we are in no man's land, then an SPX Elephant (if the index is not above its 50-day average), or an SPX Iron Condor (if the index is above its 50-day average). This would be an unbalanced position with a 4:1 ratio of Puts to Calls.

Forex

The LT Trend Sniper system finally closed its long EURUSD position initiated on July 12, after eight days went by without a new closing high.

In the end the position was held for 34 days and resulted in a 266.9 pip winner and a +6.46% boost for the Forex account. The Sniper has had a good year trading EURUSD (+9.11%) and a mediocre one trading Gold (-3.74%). Overall, the FX Account is up +5.39%, easily beating the -1.78% posted by the Barclay Systematic Traders Index year to date.

A signal to buy Gold this week almost got triggered but the triple top was rejected, at least for now:

On average, the Sniper makes 6 trades in the Euro per year (5 already this year) and 5 trades in Gold per year (only 2 so far in 2017). So, I'm expecting more activity in Gold than in the Euro for the rest of this year.

Sniper results tracked here.

Economic Calendar

Tuesday: German ZEW Economic Sentiment.

Wednesday: Europe Manufacturing and Services PMI. US New Home Sales.

Thursday: US Existing Home Sales.

Friday: German GDP and Business Climate Index. US Durable and Core Durable Goods Orders.

Good luck this week my friends.

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2017 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment