These are the tough ones to write. Right after you have swallowed some losses. Even though they are an inevitable part of any trading system, they never get to make you happy. But bravery is measured by how many times you don't hide under a rock, and this year folks, I haven't hidden myself once. Not a single weekend. I'm not ready to break that streak.

Market Conditions

(Click on image to enlarge)

Stochastics: 97 (overbought)

McClellan: +156 (overbought)

Stocks above their 20 DMA: 76% (overbought)

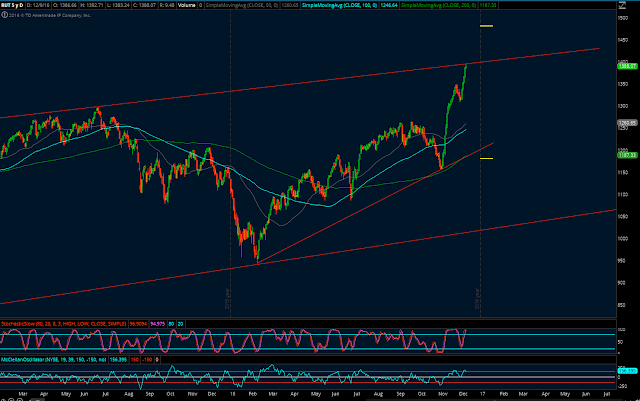

Russell:

(Click on image to enlarge)

Action Plan for the Week

My plan is to really do nothing unless I'm forced to act. I think only the DEC30 SPX Iron Condor is likely to need my attention. With SPX hitting 2,285 I may need to defend the 2305/2315. I'll probaby go with January options at/above SPX 2,370. On the way down SPX needs to break below 2,200 for me to start getting concerned about the Put side. If an adjustment is necessary I will use the same expiration in this case and a greater number of contracts.

Forex

The LT Trend Sniper system is still short Gold via XAU/USD (since November 14 midnight GMT+2 server time):

The Stop Loss is now at the 1,201.80 level guaranteeing at least 23 Gold points in profits.

Nothing will make the robot exit its short position this week (unless Stop Loss is hit of course). But, if no closing price lower than this Friday's close is made during the entire week, the Sniper will be exiting the position at the Sunday open (Dec 18)

Economic Calendar

You take a look here. My head hurts already.

Options Trading results: +5.57% for the year (S&P benchmark: +10.55%)

Portfolio 26% invested, 74% cash.

Good luck this week my friends!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2016 Track Record

Recent Trading Activity

- Closed Put side of RUT 1180/1190/121/1390/1400 Elephant on Monday for a $482 gain. The Put side had been closed last week at a $310 loss. Overall this Elephant was therefore a small winner. 4 for 4 with Elephants in 2016.

- Closed DEC30 RUT 1410/1420 Credit Call spread for a $450 gain on Monday.

- Closed DEC30 SPX 1990/2000/2270/2280 Unbalanced Iron Condor for a $1,200 loss on Thursday. Immediately opened a new 2140/2150/2305/2315 Iron Condor for $1,500 credit.

- Closed Call side of JAN RUT 1170/1180/1410/1420 Unbalanced Iron Condor for a $2,570 loss. Two days earlier additional 1420 Calls had been purchased as a hedge to delay the adjustment. All the details here. Immediately after taking the loss, a new 1480/1490 Credit Call spread was deployed. As a result, the position is now 1170/1180/1480/1490 with a total credit of $2,800. This credit is enough to cover the loss.

Well, obviously not a happy week in Lazy Land. When combining all four transactions, the week brought an overall loss of $2,838 (482 + 450 - 1200 - 2570). Or around 2.8% of the portfolio. So, not the end of the world but, obviously unfortunate. Now, looking at the two losses in particular, both of them can be totally covered. The new SPX position carries a $1,500 credit. That's greater than the loss of $1,200. The RUT Iron Condor, with its $2,800 credit also covers its loss suffered this week of $2,570. The current performance of the portfolio Year To Date is now +5.57%, but there is a total credit of $4,300 in the open positions ($1,500 + $2,800). Those amounts can quickly put the account growth at the +9.7% level. Unfortunately one of those two positions (RUT) expires in January of 2017, so its final result may not be booked this year and I won't rush it just for the mundane purpose of making this year's return look better.

With the picture clearer now and the end of the year so close, I must admit that beating the market in 2016 may not happen for me. Even though my equity curve is smoother, with way smaller draw-downs than those of the market, the total return number may not end up quite there. It was a challenging year for me not so much in terms of market price action, but mainly because I missed two months worth of Income Positions traiding. If you look at the Track Record, I traded neither February nor March "Income Trades" (Credit Spreads, Iron Condors) in 2016. You will remember that early in the year, I switched to longer term positions for experimentation. After the January Income positions, I jumped straight to April positions (skipping Feb and March). For this reason, this year I traded, for example, only 10 Iron Condors, instead of the typical 12. So, I've had to fight the markets with only 10 months worth of income positions rather than 12, and obviously that has limited my results somewhat. Not a justification, just reflecting the reason why I don't feel frustrated for not out-performing the SPX. The worst draw-down in the account this year, up to now is still 4.89% peak to trough, and I am very satisfied with it. The total return, I'm pretty confident would be 2 or 3 percentage points higher had I not missed two months.

But not all is terrible when the markets go up non-stop. Gold for example remains weak, which is lovely when I'm shorting it with the Trend Sniper robot. Also, my passive Canadian Stock holdings are up +22.6% this year, which is great (Canadian TSX Index is up +17.7% as of today). I just never talk about it because, well, it's boring. I'll provide more details about this when the year is over. So, overall capital keeps growing with well controlled risks in different fronts and that's what counts.

- Closed Put side of RUT 1180/1190/121/1390/1400 Elephant on Monday for a $482 gain. The Put side had been closed last week at a $310 loss. Overall this Elephant was therefore a small winner. 4 for 4 with Elephants in 2016.

- Closed DEC30 RUT 1410/1420 Credit Call spread for a $450 gain on Monday.

- Closed DEC30 SPX 1990/2000/2270/2280 Unbalanced Iron Condor for a $1,200 loss on Thursday. Immediately opened a new 2140/2150/2305/2315 Iron Condor for $1,500 credit.

- Closed Call side of JAN RUT 1170/1180/1410/1420 Unbalanced Iron Condor for a $2,570 loss. Two days earlier additional 1420 Calls had been purchased as a hedge to delay the adjustment. All the details here. Immediately after taking the loss, a new 1480/1490 Credit Call spread was deployed. As a result, the position is now 1170/1180/1480/1490 with a total credit of $2,800. This credit is enough to cover the loss.

Well, obviously not a happy week in Lazy Land. When combining all four transactions, the week brought an overall loss of $2,838 (482 + 450 - 1200 - 2570). Or around 2.8% of the portfolio. So, not the end of the world but, obviously unfortunate. Now, looking at the two losses in particular, both of them can be totally covered. The new SPX position carries a $1,500 credit. That's greater than the loss of $1,200. The RUT Iron Condor, with its $2,800 credit also covers its loss suffered this week of $2,570. The current performance of the portfolio Year To Date is now +5.57%, but there is a total credit of $4,300 in the open positions ($1,500 + $2,800). Those amounts can quickly put the account growth at the +9.7% level. Unfortunately one of those two positions (RUT) expires in January of 2017, so its final result may not be booked this year and I won't rush it just for the mundane purpose of making this year's return look better.

With the picture clearer now and the end of the year so close, I must admit that beating the market in 2016 may not happen for me. Even though my equity curve is smoother, with way smaller draw-downs than those of the market, the total return number may not end up quite there. It was a challenging year for me not so much in terms of market price action, but mainly because I missed two months worth of Income Positions traiding. If you look at the Track Record, I traded neither February nor March "Income Trades" (Credit Spreads, Iron Condors) in 2016. You will remember that early in the year, I switched to longer term positions for experimentation. After the January Income positions, I jumped straight to April positions (skipping Feb and March). For this reason, this year I traded, for example, only 10 Iron Condors, instead of the typical 12. So, I've had to fight the markets with only 10 months worth of income positions rather than 12, and obviously that has limited my results somewhat. Not a justification, just reflecting the reason why I don't feel frustrated for not out-performing the SPX. The worst draw-down in the account this year, up to now is still 4.89% peak to trough, and I am very satisfied with it. The total return, I'm pretty confident would be 2 or 3 percentage points higher had I not missed two months.

But not all is terrible when the markets go up non-stop. Gold for example remains weak, which is lovely when I'm shorting it with the Trend Sniper robot. Also, my passive Canadian Stock holdings are up +22.6% this year, which is great (Canadian TSX Index is up +17.7% as of today). I just never talk about it because, well, it's boring. I'll provide more details about this when the year is over. So, overall capital keeps growing with well controlled risks in different fronts and that's what counts.

Market Conditions

(Click on image to enlarge)

Stochastics: 97 (overbought)

McClellan: +156 (overbought)

Stocks above their 20 DMA: 76% (overbought)

Russell:

(Click on image to enlarge)

Current Portfolio

DEC30 SPX 2140/2150/2305/2315 Unbalanced Iron Condor

$1,500 credit. 3 weeks to expiration.

JAN RUT 1170/1180/1480/1490 Unbalanced Iron Condor

$2,800 credit. 6 weeks to expiration

DEC30 SPX 2140/2150/2305/2315 Unbalanced Iron Condor

$1,500 credit. 3 weeks to expiration.

JAN RUT 1170/1180/1480/1490 Unbalanced Iron Condor

$2,800 credit. 6 weeks to expiration

Action Plan for the Week

My plan is to really do nothing unless I'm forced to act. I think only the DEC30 SPX Iron Condor is likely to need my attention. With SPX hitting 2,285 I may need to defend the 2305/2315. I'll probaby go with January options at/above SPX 2,370. On the way down SPX needs to break below 2,200 for me to start getting concerned about the Put side. If an adjustment is necessary I will use the same expiration in this case and a greater number of contracts.

Forex

The LT Trend Sniper system is still short Gold via XAU/USD (since November 14 midnight GMT+2 server time):

The Stop Loss is now at the 1,201.80 level guaranteeing at least 23 Gold points in profits.

Nothing will make the robot exit its short position this week (unless Stop Loss is hit of course). But, if no closing price lower than this Friday's close is made during the entire week, the Sniper will be exiting the position at the Sunday open (Dec 18)

Economic Calendar

You take a look here. My head hurts already.

Options Trading results: +5.57% for the year (S&P benchmark: +10.55%)

Portfolio 26% invested, 74% cash.

Good luck this week my friends!

LT

If you are interested in a responsible and sustainable way of trading options for consistent income with solid risk management, consider acquiring LTOptions, my options trading system to the last detail.

Check out 2016 Track Record

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment