SPX went up a little bit more this week, from an opening 1502.96 on Monday to a close of 1513.17 on Friday for a 0.68% gain. The progression for the last 4 weeks has been +0.38%, +0.94%, +1.14% and +0.68%. The market keeps slowly creeping higher, defying the most skeptics out there.

I currently hold two positions in the February expiration cycle.

The SPX 1445/1450/1530/1535 Iron Condor looks like this:

(Click on image to enlarge)

Probability of success at expiration 63.16%, temporary profit of +$10. Not too comfortable, but not too bad either. This is the only position in the portfolio that could need some special attention this week. Expiration getting close in 13 days.

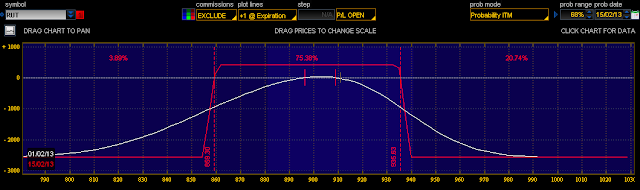

Then RUT 855/860/935/940 Iron Condor:

(Click on image to enlarge)

75.38% probability of success in 13 days and temporary profit +$37.50. Looking good here.

There is an extra one in the March expiration cycle. Also an Iron Condor:

SPX 1355/1360/1560/1565

(Click on image to enlarge)

Probability of success 74.43%, temporary loss -$25. Still comfortable, maybe a little concerning on the upside given that March expiration is still over 40 days away, but for now, this one doesn't make me lose my sleep at night.

Plan for the week

I have two main tasks this week. One is to take care of the SPX 1530/1535 Side of the February Iron Condor. It might get some hit and if it happens I will adjust it further up to 1540/1545 using February Options.

My other goal this week is to enter a second March position. I'm thinking of a RUT Iron Condor 825/830/960/965, for around 0.75 to 0.80 credit. Those break even points in terms of SPX represent a range from 1398 to 1583 using the Beta Weight feature provided by TOS (Remember that's just an approximation based on historical correlations between the instruments). Using those strikes I almost guarantee that both March Iron Condors won't be affected at the same time, because their break even points are in different regions.

Market conditions right now

With the solid candle made on Friday it is hard to forecast an imminent reversal. An elephant bar, that's what I like to call them. Greater than usual and mostly body with almost no wicks. We are still trading at the upper end of the channel.

(Click on image to enlarge)

Stochastics at 76, not overbought. (91 last week)

McClellan at 42 far from overbought. (100 last week)

73.58% of stocks are above their 20 SMA (75.72% last week)

84.22% of stocks are above their 50 SMA (84.60% last week)

Looking definitely less overbought than last week, which looked less overbought than the week before. The market has digested its gains very well via mostly sideways price action and time.

The CBOE Index Put/Call ratio showing a reading of 1.14, that's neutral, not a bullish extreme anymore. Bad sign for the Bears although the Equity Put/Call ratio at 0.57 still signaling a bullish extreme.

I believe there are good chances for this thing to keep slowly going higher this week.

On the Forex Front

The LT Trend Sniper system entered a long EURUSD position on Sunday at 1.34672. Currently riding the trend with +171.50 pips in positive territory.

For more details

LT Trend Sniper - A forex strategy that works

LT Trend Sniper Characteristics and Backtesting Results

LT Trend Sniper live testing Results

Economic Calendar

A fairly light week with Factory Orders on Monday, ISM Services on Tuesday, and

International Trade on Friday the main economic data.

Good luck this week folks!

Check out Track Record for 2013

I currently hold two positions in the February expiration cycle.

The SPX 1445/1450/1530/1535 Iron Condor looks like this:

(Click on image to enlarge)

Probability of success at expiration 63.16%, temporary profit of +$10. Not too comfortable, but not too bad either. This is the only position in the portfolio that could need some special attention this week. Expiration getting close in 13 days.

Then RUT 855/860/935/940 Iron Condor:

(Click on image to enlarge)

75.38% probability of success in 13 days and temporary profit +$37.50. Looking good here.

There is an extra one in the March expiration cycle. Also an Iron Condor:

SPX 1355/1360/1560/1565

(Click on image to enlarge)

Probability of success 74.43%, temporary loss -$25. Still comfortable, maybe a little concerning on the upside given that March expiration is still over 40 days away, but for now, this one doesn't make me lose my sleep at night.

Plan for the week

I have two main tasks this week. One is to take care of the SPX 1530/1535 Side of the February Iron Condor. It might get some hit and if it happens I will adjust it further up to 1540/1545 using February Options.

My other goal this week is to enter a second March position. I'm thinking of a RUT Iron Condor 825/830/960/965, for around 0.75 to 0.80 credit. Those break even points in terms of SPX represent a range from 1398 to 1583 using the Beta Weight feature provided by TOS (Remember that's just an approximation based on historical correlations between the instruments). Using those strikes I almost guarantee that both March Iron Condors won't be affected at the same time, because their break even points are in different regions.

Market conditions right now

With the solid candle made on Friday it is hard to forecast an imminent reversal. An elephant bar, that's what I like to call them. Greater than usual and mostly body with almost no wicks. We are still trading at the upper end of the channel.

(Click on image to enlarge)

Stochastics at 76, not overbought. (91 last week)

McClellan at 42 far from overbought. (100 last week)

73.58% of stocks are above their 20 SMA (75.72% last week)

84.22% of stocks are above their 50 SMA (84.60% last week)

Looking definitely less overbought than last week, which looked less overbought than the week before. The market has digested its gains very well via mostly sideways price action and time.

The CBOE Index Put/Call ratio showing a reading of 1.14, that's neutral, not a bullish extreme anymore. Bad sign for the Bears although the Equity Put/Call ratio at 0.57 still signaling a bullish extreme.

I believe there are good chances for this thing to keep slowly going higher this week.

On the Forex Front

The LT Trend Sniper system entered a long EURUSD position on Sunday at 1.34672. Currently riding the trend with +171.50 pips in positive territory.

For more details

LT Trend Sniper - A forex strategy that works

LT Trend Sniper Characteristics and Backtesting Results

LT Trend Sniper live testing Results

Economic Calendar

A fairly light week with Factory Orders on Monday, ISM Services on Tuesday, and

International Trade on Friday the main economic data.

Good luck this week folks!

Check out Track Record for 2013

Go to the bottom of this page in order to see the Legal Stuff

No comments:

Post a Comment